Advanced Harmonic Patterns - A Predictive Price Model

Some of the least ambiguous patterns are of the harmonic variety. With a detailed set of rules (advanced) and lots of re-tracement waves (harmonic), these can help identify price reversal trades.

Harmonic patterns were first most popularly documented by H.M. Gartley is “Profits In the Stock Market” (1935). The original pattern was described as the Gartley Reversal Pattern. Scott Carney later refined the rule set and established other popular patterns such as “Bat”, “Butterfly” and “Crab”.

The Investopedia article can be found here :https://www.investopedia.com/terms/g/gartley.asp

Before beginning harmonic analysis, its important that the trader or investor understand how to identify pivots and make basic distinctions between major an minor pivots on timeframe. Pivots will be where we place our X,A,B,C,D or 0,1,2,3,4. The weekly chart on the EURUSD explains below. There is a degree of subjectivity, as all charts are essentially fractals. Relative to your timeframe and zoom, you should be placing the points on the swing pivots that exist, not the pattern you hope to exist!

Once you have the pivot identification concept down, you can move to the drawing and recognition of the Gartley pattern.

The rules are as follows (note some people use XABCD instead of numbers):

Given a leg in the price action 0 to 1.

1 to 2 will retrace 61.8% to 78.6% of 0 to 1

2 to 3 will retrace 61.8% to 100% of 1 to 2

3 to 4 will trace a fib extension of 1 to 2 of 127.2% to 161.8%

The forecast (trade entry) next move of 4 is in the reversal (blue line) direction. Do not place a limit order in the 3 to 4 move to catch the falling knife like a textbook may tell you. Wait for confirmation! Whales read textbooks and will blow your stop.

Wait for confirmation before entering

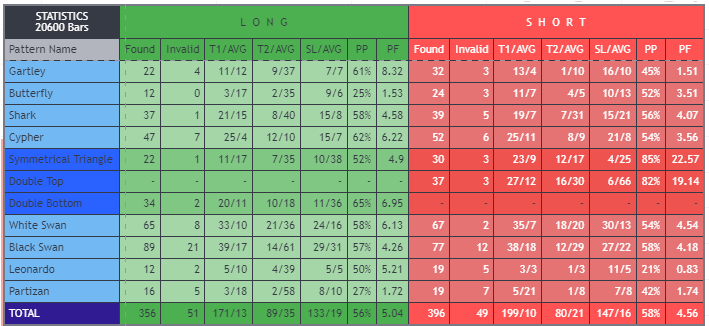

This is not a terrible trade even with the bull-headed aggressive entry. But frankly, you should be winning more than 50% of gartley patterns with proper confirmation. In the example above (EURUSD 1h) my pattern recognition tool found 22 Gartley patterns and simulated trades with all of them. 11 of them won and 11 lost. Trade was completed in less than a day on average. We can do better.

Once a pivot point at 4 is established on the chart, we stop limit buy (longs) 10% above the pivot and the back test shows we ditched 4 bad trades using this discipline. Our win % improved to 61%. Not great.

At 20% we ditched 3 more losing trades and now we are starting to see Gartleys win 70%+ of the time (I prefer black swans and cyphers personally). Stop busting is a real thing and with any reversal pattern you need to have a disciplined plan to confirm pivot below your entry. This applies to head and shoulders, double bottoms etc.

Additional patterns

I describe the original Garley above. The other patterns: crab, shark, bat, butterfly, black swan, cypher… all have unique set of Fibonacci rules and a drawing tool in Tradingview.

Putting it together

Waiting for the 3 to 4 leg to draw itself out can be a real drag. It just so happens there is a major Gartley pattern forming in URNM 0.00%↑ .

Zooming in we see sellers on the daily chart at $35. I would expect a right shoulder formation here. That would be your entry!

***Backtesting powered by harmonic patterns pro by LonesomeTheBlue on tradingview: https://www.tradingview.com/u/LonesomeTheBlue/#published-scripts

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.