Anatomy of a Whip: The Precious Metals Bull Market

With proper investment segmentation and toolkit, you can maximize risk/reward to make the most of a lifetime opportunity.

Learn the dynamics of the whip, or get hit in the face…

Let’s start with some terminology….

Leverage - A situation, generally provided by a tool or machine (perhaps a shovel or a bicycle), where output can be measured by a positive multiple on the input. In finance, the return or loss is measured by multiples of the change in the underlying price of the asset. Put another way, movement is derived from underlying price… or a derivative. Properly applied, can produce surprising results!

Optionality - Leverage. Sometimes it refers to multiple layers of real and financial options. A company has the REAL OPTION of exploration, new mines and acquisitions IN ADDITION to the multiples they make as a derivative of the underlying commodity.

Convexity - The amplitudinal effects of leverage applied to the system. Asymmetry… or, as we would like it, rewards that vastly outweigh risk.

Concavity - derivatives can often be used to tamp leverage or reduce volatility. We math nerds categorize this as concavity (the other side of convexity). Term is provided for completeness and is beyond the scope of this anatomy.

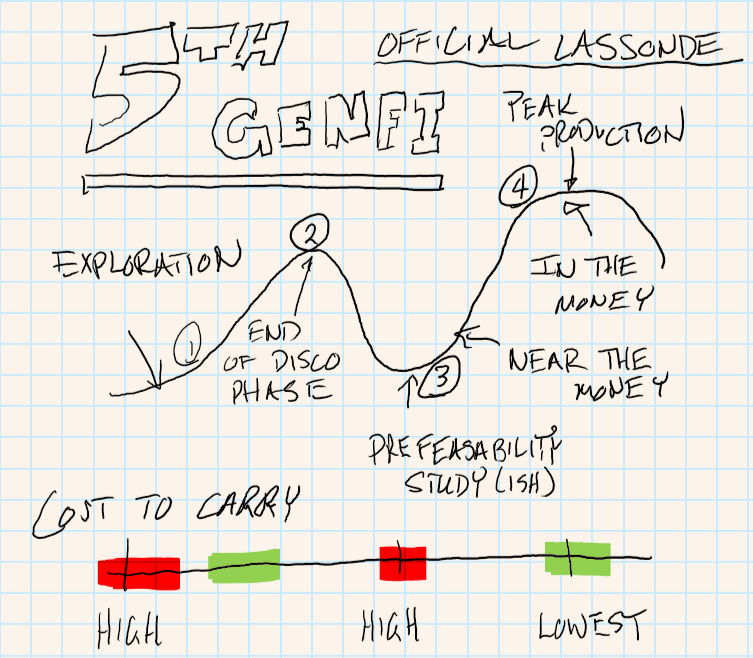

Cost to carry - this is a term commonly used in futures market, but it is true in almost all of life. It costs something to own anything. That may be a cost of time. It may be a cost of freedom, but rest assured there is a cost. If you are keenly unaware, chances are that cost is high. In the case of investing, “cost to carry” is the amount the market charges you to HODL (hold on don’t let go). Futures traders are looking for carry arbitrage or premium to carry. The day oil dropped to negative numbers was a great day for the oil storage business. The premium to carry was off the charts. Even without speculation, they could lock in a whopping $20 a barrel in the front months contracts and get the oil FOR FREE. That’s called a carry trade or futures “backwardation”. Like all arbitrage opportunities, gaps get filled, deliveries get made and closets get cleaned to pick up virtually risk-free fees. “You’ll bunk with your brother, and you’ll like it”. Carry trades are generally elastic and disappearing.

For the purpose of the investors “thought experiment”, the question needs to be, “what is the cost of sideways?” Is the money I have tied up in XYZ costing me by not working elsewhere, or worse still, being eaten alive by inflation. It’s not whether our time and money bare a cost to carry, it’s “how much does it bare?”

Gold has lower storage fees as a percent, than Silver. Companies that are looking for production are likely diluting their balance sheets more than companies who have production. The best ones will pay you to hold their stock (dividends).

Options traders call the “cost to carry” EXTRINSIC VALUE. High fees, commissions and taxes, no problem, that’s just EXTRINSIC VALUE! By now a pattern should be emerging. The higher the leverage, the higher the EXPECTED RETAIL cost to carry. Emphasis on the key words… never pay retail.

Precious Metals - Metals who’s rarity eclipses utility relative to human demand. Portable, desirable, beautiful, collectable, identifiable… Gold, Silver, Platinum, Palladium include the majority of the list.

10-Bagger - The unicorn of speculative investments. It simply means you achieved 10x return on your investment.

Bull Market - We are going to define this as a stage 2 breakout on at least a weekly chart. See the Stage Analysis Market Model:

Visualize and ask your listeners to visualize a bull market as a circus master's whip. The handle in the front of the whip is the commodity. It moves first. The high quality gold stocks are the next part of the whip. They move next but they move further. The mid tiers, they're the middle of the whip. They move after the other two. They move further. And then the end of the whip are the penny dreadfuls. They don't move for a while but when they move they move further and faster. -Rick Rule

Are We in a Precious Metals Bull Market?

The simplest of questions, but the most important. Yes for gold and silver, it depends for platinum and miners.

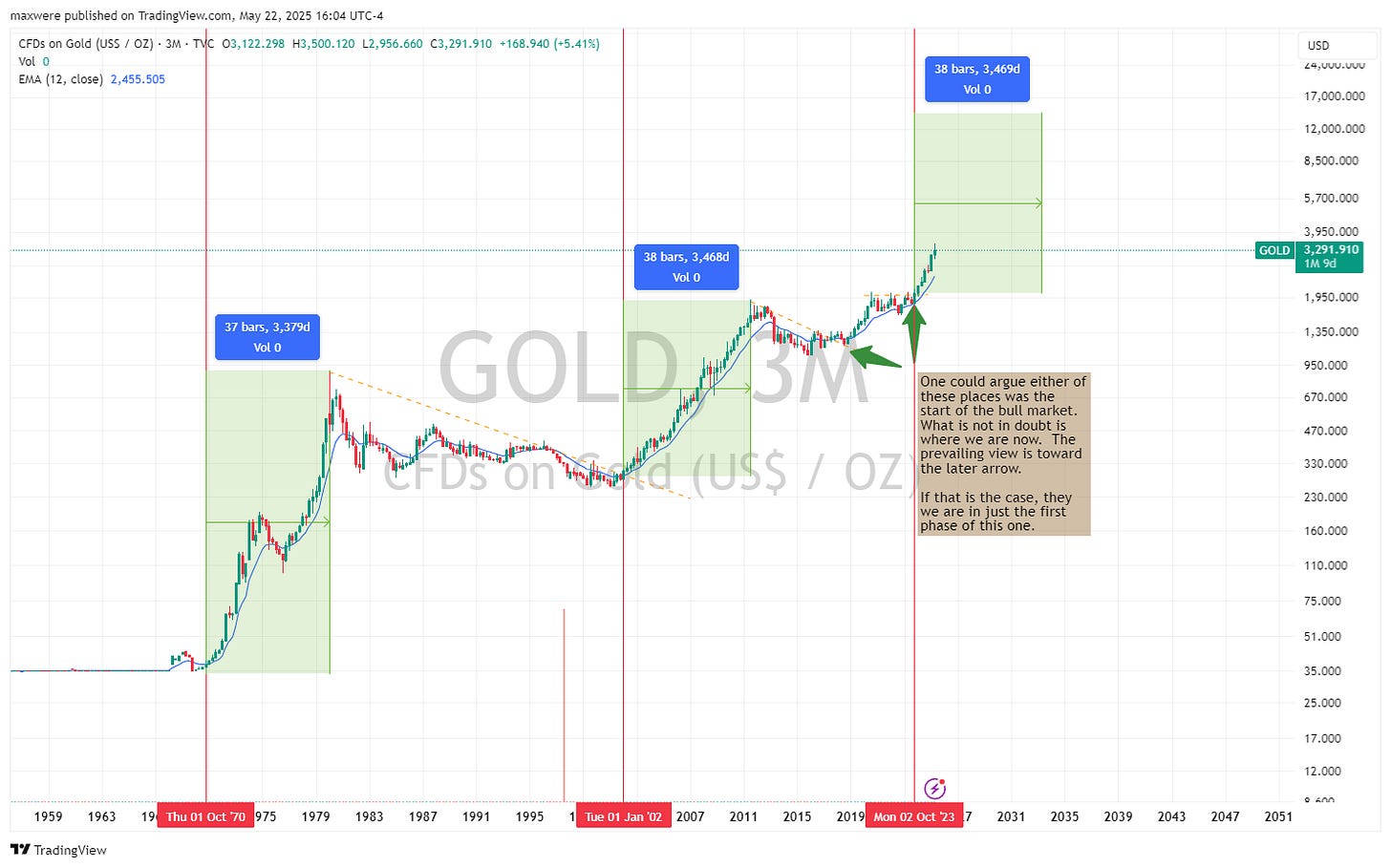

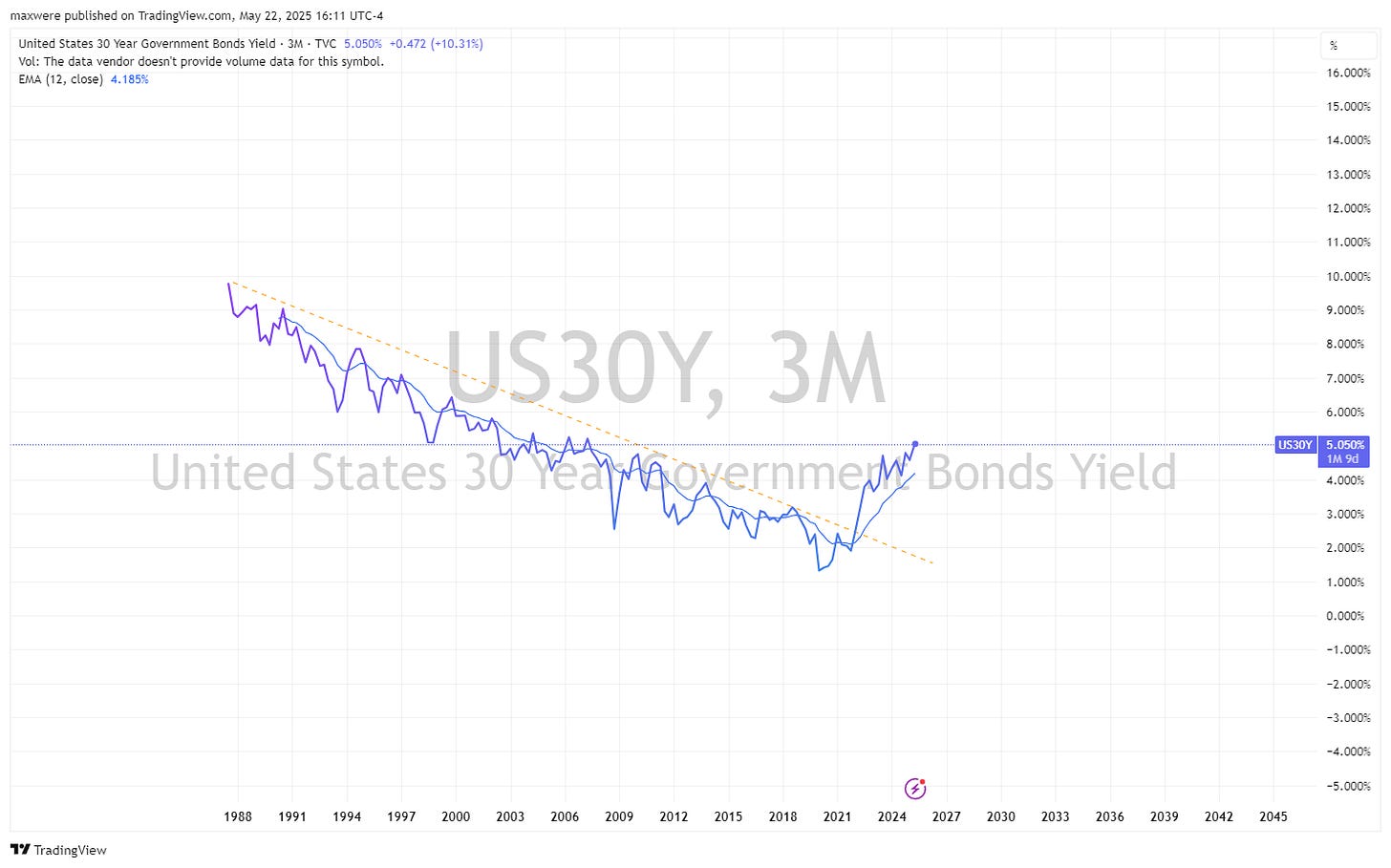

The shape of long duration treasuries suggests; yields move much higher. This is consistent with macro and current state of global debt, supply and demand. We are early.

Now that we can clearly see that part 1 includes a defined movement in the price of gold, let’s look at a framework…

Elliott Wave Theory

Perhaps a good framework for the anatomy is the popular thesis attributed to the emergence of Elliot Wave patterns. The exact science may not be applicable, but it often seems as if major long-term moves can be divided into shorter term segments of 3. The theory itself contends 5 legs: 3 major impulse moves 0-1,2-3,4-5, with 3 minor retracement/consolidation breaks. Of the 3 main legs, its thought that the first is dominated by “smart” money… not a result of previous price, but of the wisest investors recognizing and imbalance in price and value. The second such wave, usually deemed to be the largest, involves a mix of savvy retailers and institutions getting in on the momentum of the initial price break. The third is strictly reactionary to the first 2. This is thought to be dumb money… and a sign of the end of the run.

For the purpose of the mental framework, let’s consider rule of 3 to be a general framework for the bull market. The exact point at which leg 1 becomes leg 2 may or may not be clear. But suffice it to say, it will happen and that will indicate the more levered segments should outperform gold.

Silver: A Second & Third Act Performer

Above is the long-term price of gold with the ratio of silver to gold below. If this is a 3-act performance, look for silver to show up after or near the end of the 3rd act.

The prevailing theory behind this behavior is big/smart money moves first in the wealth transfer to gold and the rest play catchup via silver. Silver’s much lower price and low float to gold creates a bit of panic buying in the price. Large players have been known to buy up in a hording type of behavior.

Gold Miners: Also, a Second and Third Act

Gold miner data is spotty at best. Companies come and go. Dilution is the norm in bear markets. The chart would appear to suggest it makes an appearance around the time silver does. That is our starting thesis, at least.

Gold miners as a broad category lacks proper investment segmentation. Market participants are looking for gold and companies that can produce gold, not companies that think they know where to look for gold.

The Hierarchy So Far

Gold moves first (first 3rd)

Silver and existing gold producers move second (2 & 3rd acts)

All the others: silver miners, junior developers and producers, junior explorers, secondary precious metals.

The Others… the Lassonde Curve Segmentation

Basic Segmentation (my framework)

From here on (aside from silver) no one should accumulate and hold these in bear markets. Simply put, the cost of carry is going to dilute your value until the precious metals bull market ensues. Stage 2 speculation on the other hand, is something entirely different. That is where we find ourselves.

Silver and Gold Major Producers (position 4 - Fig1)

Silver during second two thirds to half of the bull market, trades at 150-250% leverage to the price of. That means that if this bull market takes gold from $3300 to $10k at the top (not a prediction), silver will see $130 to $250. This has to do with price catchup (the whip), tighter float and the public euphoria. Silver does have a higher cost to carry as a percentage of its value (storage fees), but that is negligible when price is moving up and to the right.

Gold major producers present an even more delightful situation. As realtors say, the most important thing is location, location, location. Well, that’s important until the premium of “in your hand” is far less desirable than “in the ground”. Once the market realizes higher prices are a more permanent fixture, they are much more likely to look to purchase producing stocks. Once those stocks provide returns in the form of price and dividends, they become even more popular. It’s reasonable to expect gold producers, with multiple jurisdictions and mine assets to follow gold price movement near the end of the 1st act. You can expect 250% to 350% leverage to the price of gold and potentially, a credit to carry. You see, many of these companies pay a modest dividend in stage 1,2 & 3. They are liable to dilute or destroy capital in the bear markets, so they are to be sold before the end of the bull.

Gold and Silver Mid Majors (position 3&4 - Fig1)

This group of companies include tier 2 assets, producers and near-term producers with a single mine and mid cap past producers with lower volume or significantly less than name plate capacity (the 100% production level of an asset). This is a broad category. Chances are there is a modest cost to carry or a modest premium. These are best bought when the project is online or coming online and there are but a few snags that could derail the feasibility study or economic plan. Expect these companies to fair well right around the start of the second act with approximately 4x leverage to the metal prices. Risk is far higher than majors, so position sizing or proper stop loss settings should be used with rigor.

Option Spreads on the Majors and ETFs

Bullish debit spread opportunities should continue like the one from last fall. The article details how the combination of a properly placed spread and solid entry signal can create 3-4x leverage against the price of the underlying asset. This can yield upwards of 8-10x leverage to the price of gold! I will be looking for more of these and posting for the paying members as the bull market matures. The option liquidity is generally limited to NEM 0.00%↑ , AEM 0.00%↑ , WPM 0.00%↑ , FNV 0.00%↑ , GDX 0.00%↑ , B 0.00%↑ and possibly more as prices move higher. Higher prices and volume attract more option liquidity, so the expectation is that number of possible setups will increase as the bull market matures. Position size is critical as risk of loss is possibly as high as 100%.

For a detailed review on study in leverage and risk reward, I recently published a detailed back test on my intended strategy here:

Gold and Silver Juniors (position 1&2 - Fig1)

This last group is where all the 10 baggers purportedly lie. Likewise, it’s where most of the 0 baggers are as well. Expect these to move last and the farthest. Skill in analysis and market understanding should be applied with these stocks. They are known to realized leverage of 8x or much more relative to the gold price. The cost to carry is also the highest. Most of these companies burn cash in the form of general and administrative expense and capex. Capex has been known to experience cost overrun. This is a space for the savvy speculative investor or the chartist with good breakout indicators. These stocks rarely go sideways for very long but have high convexity (upward asymmetry).

Summary

Below is a summary of when to look for higher optionality opportunities. The featured leg is very approximate and only gives an indication of what types of opportunities to be looking for when. I’m of the opinion that we are late in the first leg of 3 leg bull market and Silver (all secondary PMs), mid-caps and near-term developers and options plays on the majors may be the highest risk reward plays in the near future. Keep your eyes peeled.

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* Options trading carries a high risk of loss of capital. Trade at your own risk

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.