As Easy As Picking up Bags of Cash!

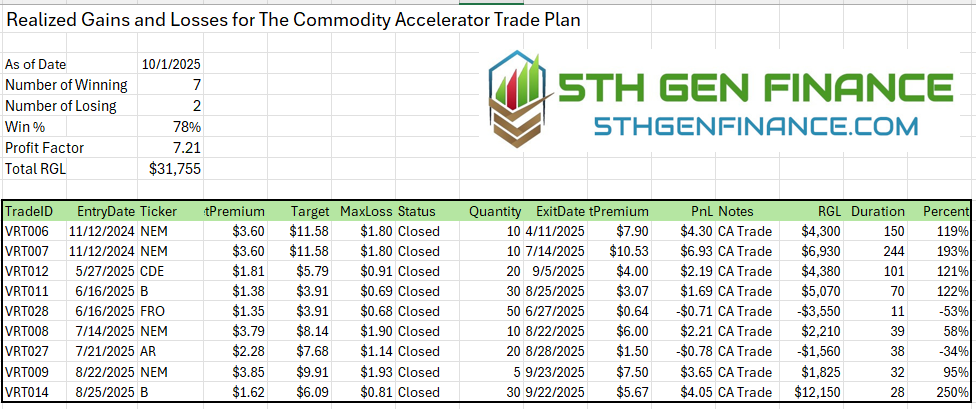

Once you learn the complicated parts, the rest is just carrying the bags! These are the results of the premium commodity accelerator trade alerts through 3Q.

After a full day of development work, I finished up my derivative tracking tool. Thanks to the malpractice of all things data modeling I’m able to build a simple copy and paste reporting tool for both UGL and RGL… a quick refresh going forward. Careful recording of any trading plan is essential to maximizing its value. (Options are a real pain if you don’t regularly log your average entry and exits)

That exercise in the rear-view, lets cover some disclosures:

The option strategy is a vertical spread trade married with triangle breakouts. It uses both technical an quantitative analysis to identify opportunities.

The actual execution of the trade isn’t more than an intermediate level. I cover the mechanics here. (think or swim)

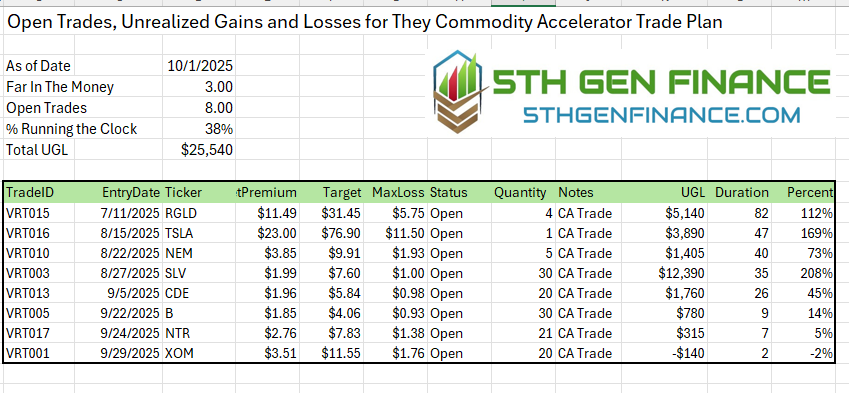

The trade should continue to work well in highly liquid bull markets such as PMs and Energy and others. You haven’t missed a thing.

The results are roughly based on individual trade risk of $2k per trade. I would say 1k risk might be the lowest feasible.

I expect about 75% win/loss ratio and 4/1 reward to risk. (that’s REALLY GOOD)

This investment approach works in retirement accounts if you are approved for options trading!

I have been able to capture a leveraged bull run on PMs the last quarter. Recent results may not be realistic in the long term (in terms of how quickly they emerged)

These are my actual transparent financial results. I still consider this a “pilot portfolio”. The trades on the stack are the very best, my entire pilot is roughly 33 trades YTD.

The metric “running out the clock” is a simple way of saying these won’t be losing trades. How much they win remains to be seen. TSLA 0.00%↑ , NEM 0.00%↑ , RGLD 0.00%↑ and SLV 0.00%↑ are very close the the winners circle above. This will push win/loss well above 80%.

Read the full plan here:

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model’s recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* Options trading carries a high risk of loss of capital. Trade at your own risk

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.

The spread range is a function of what's in the market. Get the entry/direction right and it won't matter. BUT, the tool lets you see the value of what the market is offering. Generally its at the money long leg, but if your conviction was more vertical, you could chose further out of the money. Exp date is tricky, I'm allowing +3 months beyond what I think will happen. This is also a shopping excersize. What kind of deal is the market offering in terms of liquidity and vol prem?

Hello Robert - a couple basic questions here pls, after reviewing your posts / tutorials. The workflow-progression of a trade: 1. Select security based on your conviction / indicators. Enter ticker into CA Ssheet. 2. Determine expiration date >6mos., enter that date into CA ssheet. Buy the long call ATM or 1-2% OTM. QUESTION: How to establish the short call strike price, to ensure 300% leverage? Can you please provide a short but specific example for this. Thank you.