Boss Energy Meets Mr Slammy!

Is Boss still worth hanging on to, or is it time to look elsewhere?

Summary

Price drop is due to lack of faith in the forecast assumptions of prior feasibility studies. In financial forecasting, once you lose faith in key forward projection assumptions, bets are off. The degree of the drop has been roughly targeted to major support at $2 AU.

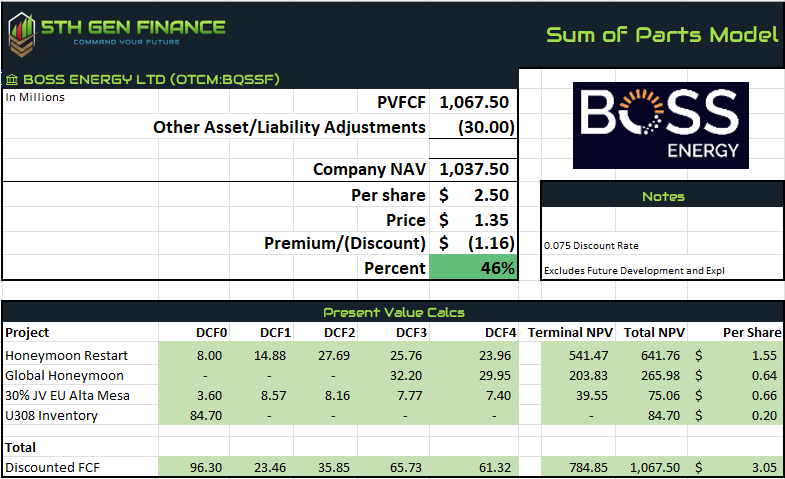

Based on the new information, the price revision is roughly $3.75AU $BOE.AX.

The issue isn’t with the new information; it’s with the trajectory of the new information!

Review

The financial health of the company, cash production had investors piling in and the company has gotten over its skis in terms of market price. PDN 0.00%↑ EU 0.00%↑ have all taken their licks, so in some way this news was overdue.

We have favorable results from Alta Mesa JV, inventory as supporting tailwinds. Also, our general understanding is that a percentage (perhaps 30-60% of nameplate) can be achieved with the current working capital, but the higher cost of capital and additional well field development is further on the margins. In addition, ISR capex is the least intensive. We feel that the company will be able to fund the additional costs through its current cashflow stream, inventory level and liquid assets.

Mineral Stocks Investor had a nice thread this morning: https://x.com/mineralstocks/status/1949729528542114124

Revised valuation is based on the following assumptions:

All in costs of $50/lb

Forward U308 price of $70 USD

Alta Mesa current forward plan and nameplate timeline (Alta Mesa has been outperforming of very late)

$70usd for current U308 inventory (may have to sell at current prices to raise capital)

Assumption of 30m USD capex (40m AU reported) for additional wellheads plus 20m USD ($3/lb) for additional capex (baked in higher AISC).

discount rate of 7.5%

Past is Prologue?

I’ve yet to be hurt buying selloffs like these. Among those that come to mind:

Silvercrest 2023 - mineral restatement of -13% (stock sold off 25%)

Newmont 2023 - higher than expected AISC by $100 (stock sold off 13b)

Paladin 2025 - flooded for a month (stock sold -30%)

Encore 2025 - very similar situation… 50-60% sell off. CEO left. Charts have some similarity. (Today’s operational reports were very good)

The pattern is very punitive to producers. It may not be prudent to go “all in” (it almost never is). But I see a case where sell EU 0.00%↑ and buy $BOE.AX is the order, if only due to favorable pricing and the NPV arbitrage.