Can You See A Merger in Your Future?

What if you could predict mergers acquisition and share structure changes? Well, much like the weather, you CAN forecast their likelihood. That's the subject of our next AI project!

The list analyzed is this one:

https://x.com/DonDurrett/status/1981470502633033889

I would expect Don Durrett to have few near takeouts and the model agrees. These are very high level risk summary of the list. If you examine any company in depth you will get a very detailed analysis of who is likely to buy and what they are likely to pay for it! This model will be released to paid and founding subscribers next month!

DISCLAIMER: All models are wrong! Some models are useful. Some models are MORE useful than others (this one hopes to be one of those). The information provided is for educational and informational purposes only and should not be construed as investment advice. All investments carry risk, and past performance is not a guarantee of future results. Trading options involves a high degree of risk and is not suitable for all investors.

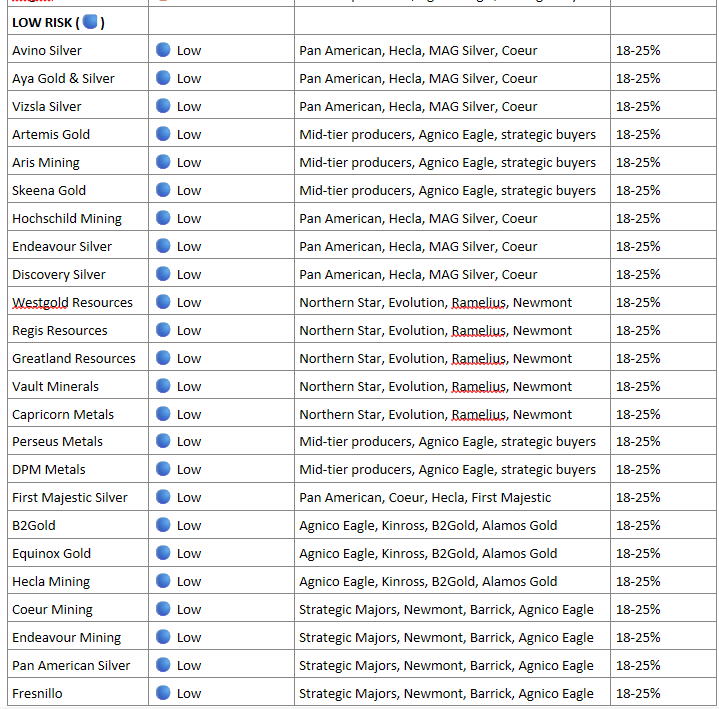

Mining Acquisition Risk Analysis – 46 Gold & Silver Companies (18-Month Horizon)

Based on the Mining Acquisition Predictive Model v2.4 (October 2025), the following table presents acquisition risk assessments for 46 gold and silver producers, developers, and explorers. Companies are ordered by acquisition risk from Very High to Low.

Summary Table (Ordered by Acquisition Risk)

Key Findings

Highest Risk Targets (Most Likely Acquisitions):

Lahontan Gold and Denarius Metals present the highest acquisition probability within 18 months due to micro-cap size (<$50M USD) combined with development stage assets

Developer cluster (P2 Gold, Revival Gold, Silver Storm, Norsemont, Nexgold) represents prime acquisition targets with 30-38% expected premiums

Risk Distribution:

Very High Risk: 2 companies (4%)

High Risk: 12 companies (26%)

Medium Risk: 9 companies (20%)

Low Risk: 23 companies (50%)

Model Insights:

Companies under $500M market cap in the development stage show the highest acquisition probability

Mid-cap producers ($500M-$2B) in the current bull market environment receive enhanced scores per v2.4 updates

Large-cap producers (>$10B) like Fresnillo, Pan American Silver, Endeavour Mining, and Coeur Mining are unlikely acquisition targets except by strategic majors

Australian producers are most likely to be acquired by Northern Star, Evolution, or Ramelius

Silver-focused companies attract interest from Pan American, Hecla, MAG Silver, and First Majestic

Look forward to seeing the model. Is the premium expressed above here based on current price or price at the time of acquisition?