Credit Markets - GFC 2.0 or "Everything's Fine"

Are cracks showing in the banking and credit sector? Is a banking crisis right around the corner?

It seems these days modern finance is all about the next great arbitrage/spread opportunity. I like the think quants, financial engineers and actuaries (yours truly) all have a romantic asphyxiation with building the risk-free money printing machine.

Ah yes, the life of ease. We stroll through idyllic landscapes, vacation in the Alps while our money printer (fully automated) slaves away at the provisions of our future… all because we are smarter than everyone else. After all, if this “risk free money printer” breaks down, we’ll build another… and another.

Ego has a way of catching up with the culture…

Are we due to a banking liquidity crisis? …and is it eminent? Yes, and no.

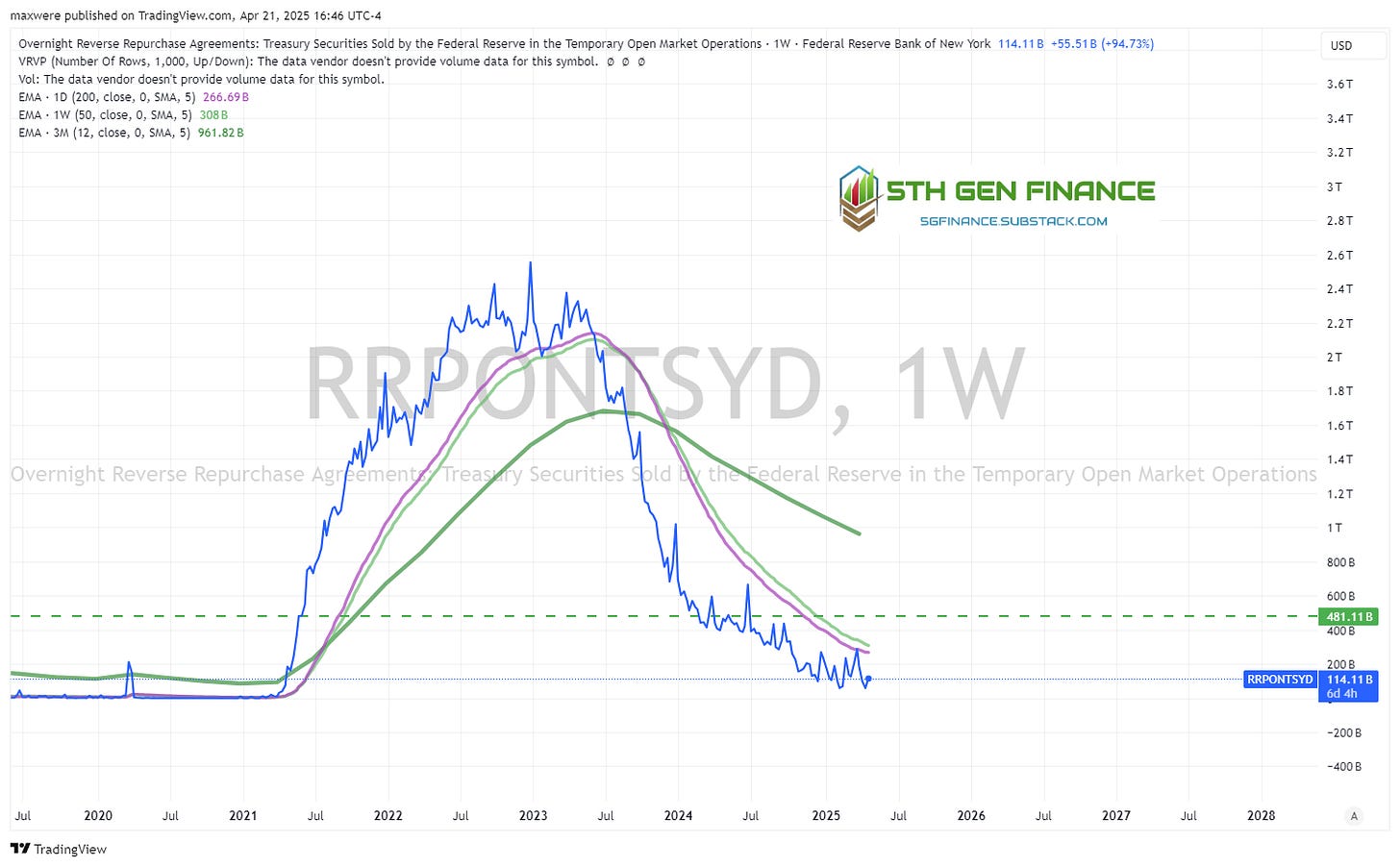

Measuring Financial Stress 1 - Overnight Liquidity

Fed repo market is effectively 0 at the moment. This is the fed window for overnight cash borrowing in exchange for collateral (treasuries)

Fed reverse repo market - This is the fed window that allows banks to park cash in exchange for treasuries. Today resulted in a 50b increase which nearly doubled the amount in the repo facility. In a liquidity crisis, this line will be very close to $0. Bookmark the chart and keep an eye out.

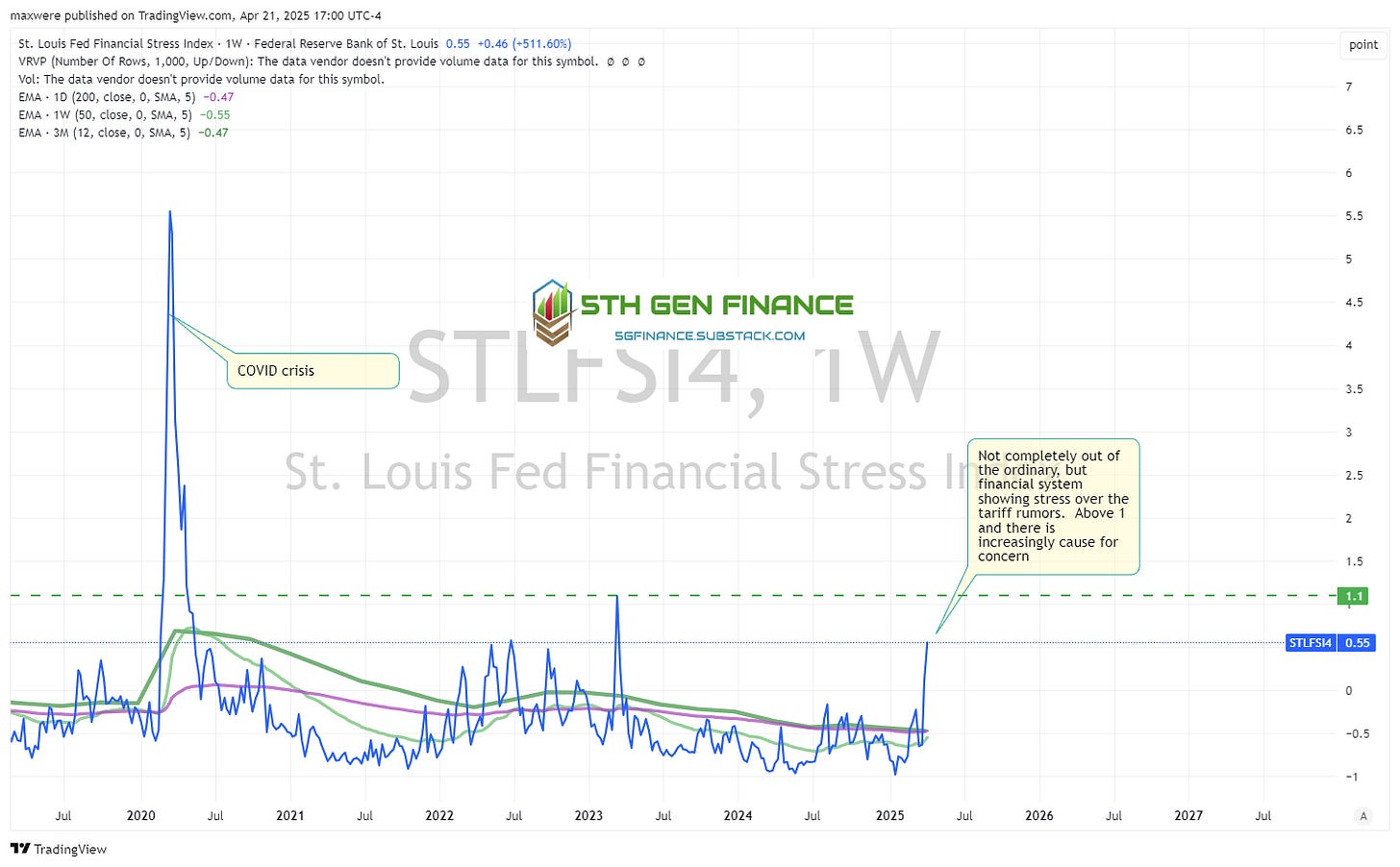

St Louis Stress Index

Recent sharp move upward could be an early warning signal.

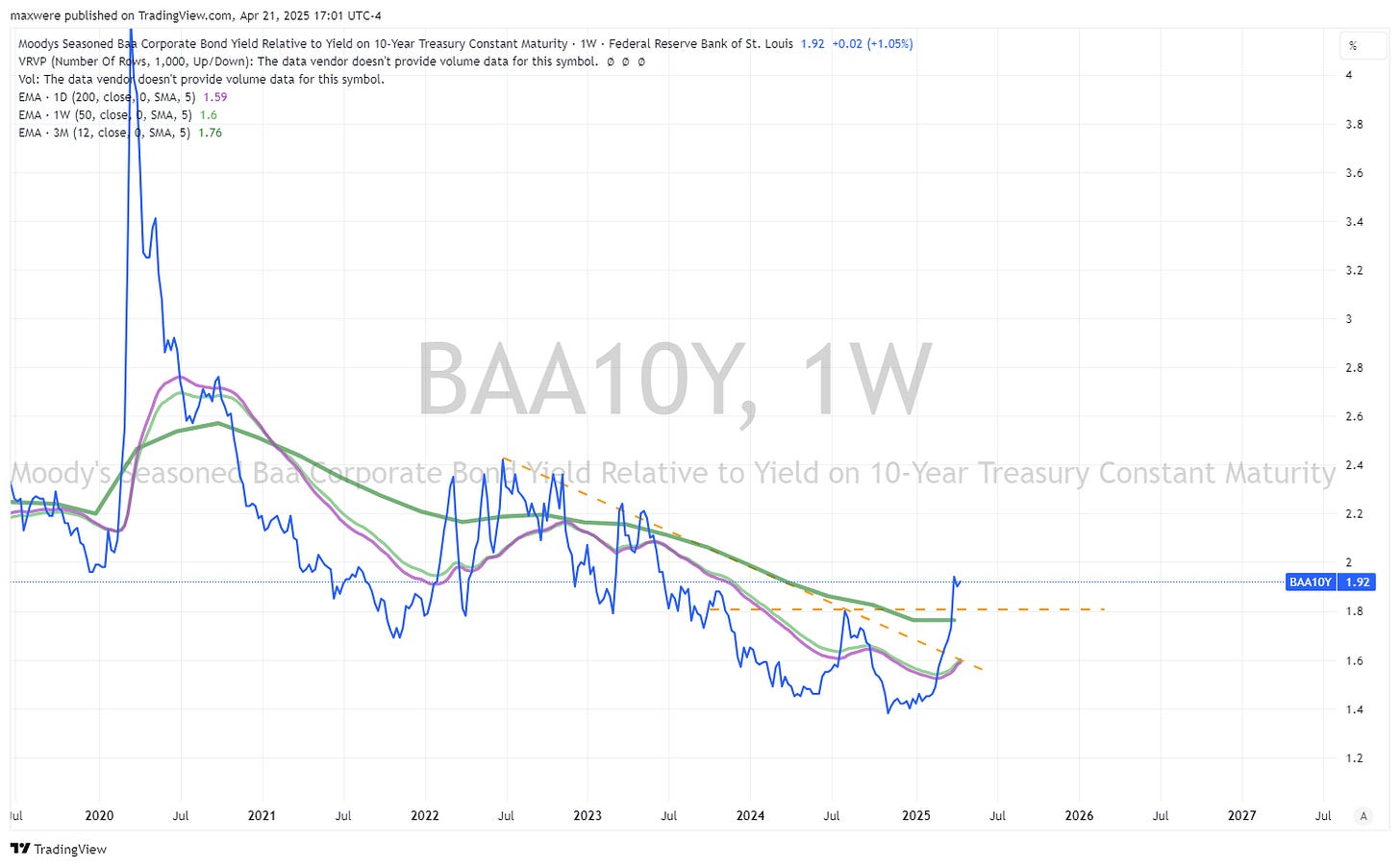

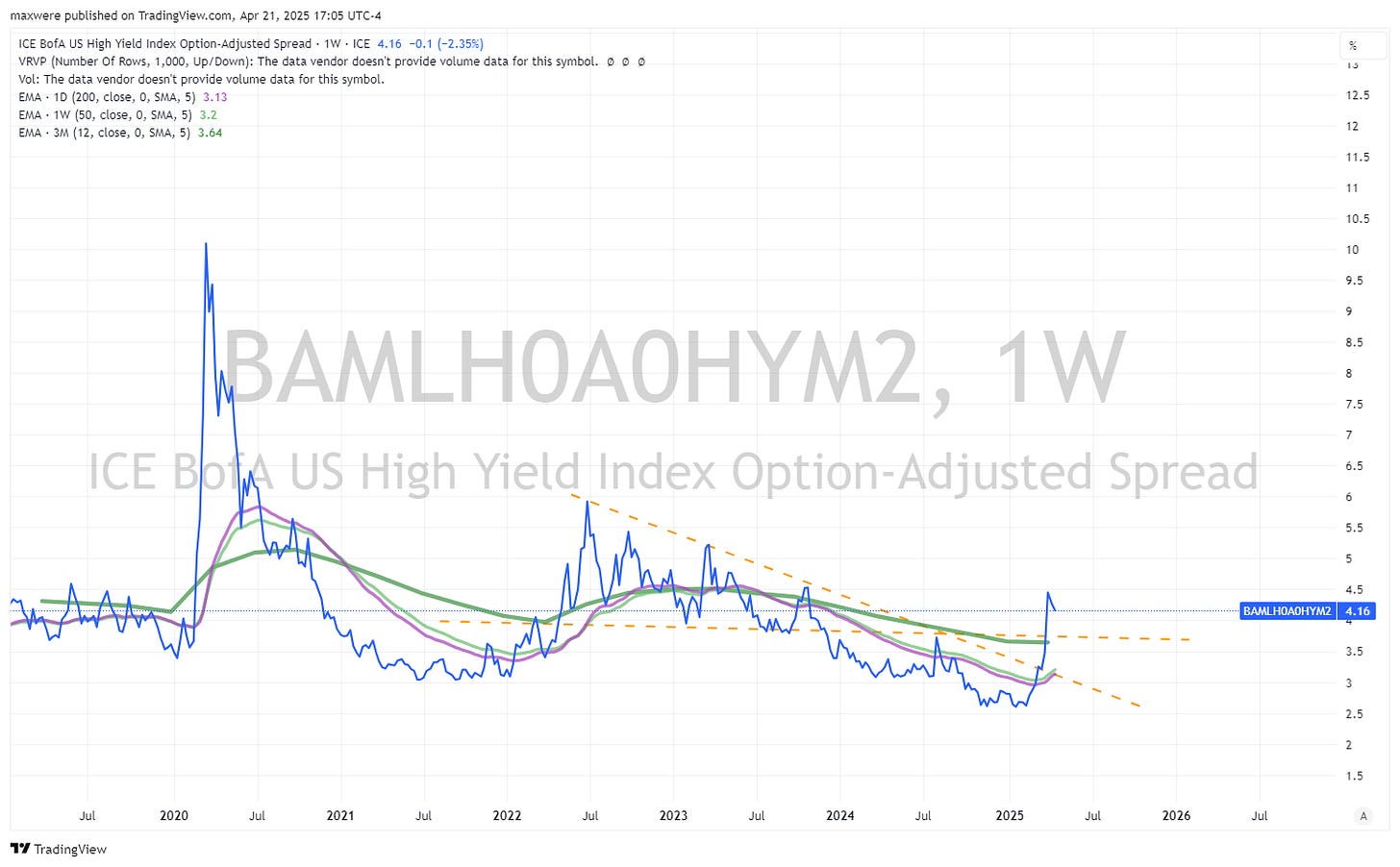

Financial Stress Point 2 - Bond Credit Spreads

Baa corporates vs 10Y treasuries. This is a very bullish chart from the point of view of widening corporate credit spreads. A move to 300bps would certainly give clear indication of financial trouble. Keep in mind 10y treasuries are relatively elevated.

High Yields - show a similar breakout. We would conclude medium term change in trend in the bond credit market, but nothing catastrophic yet.

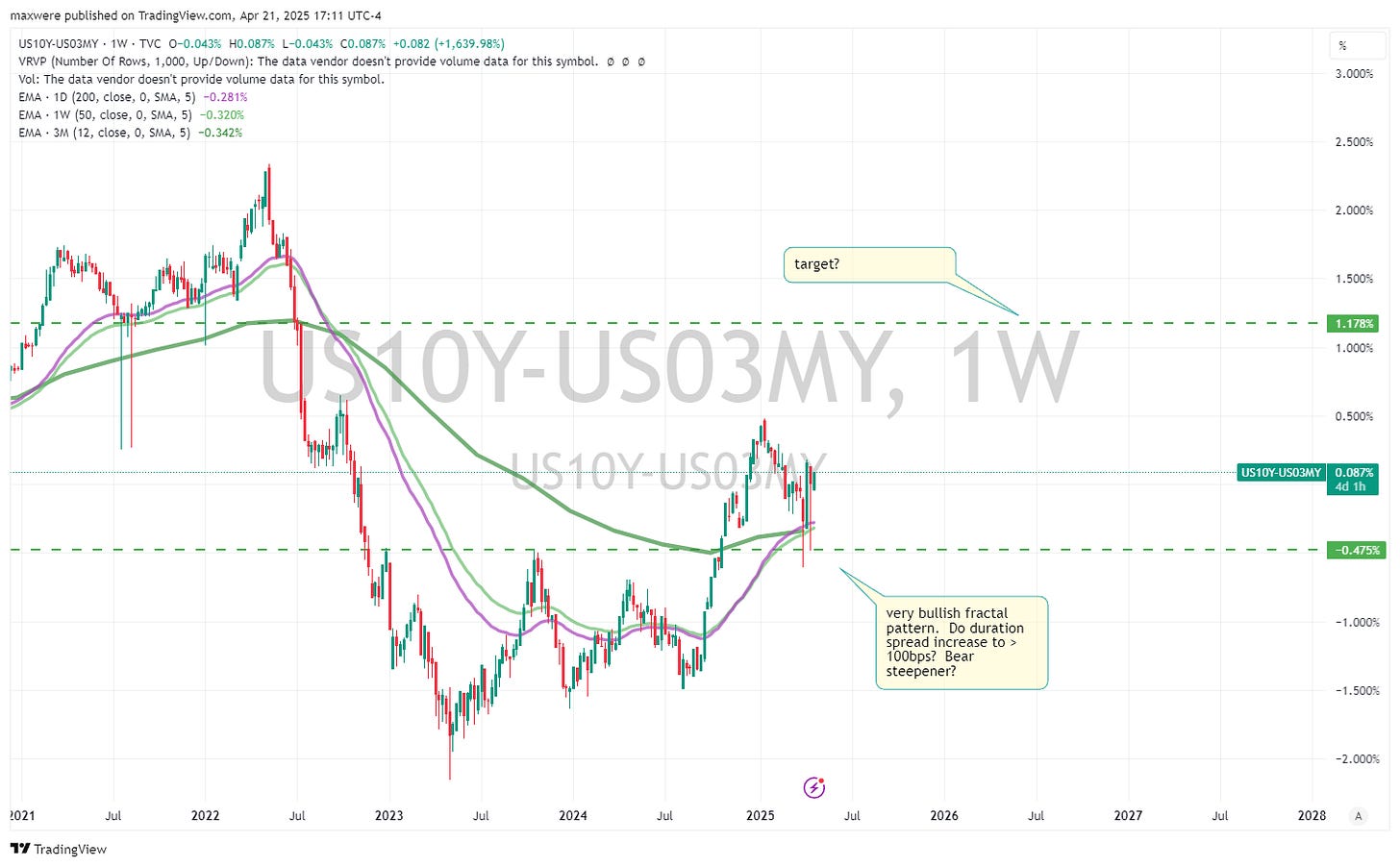

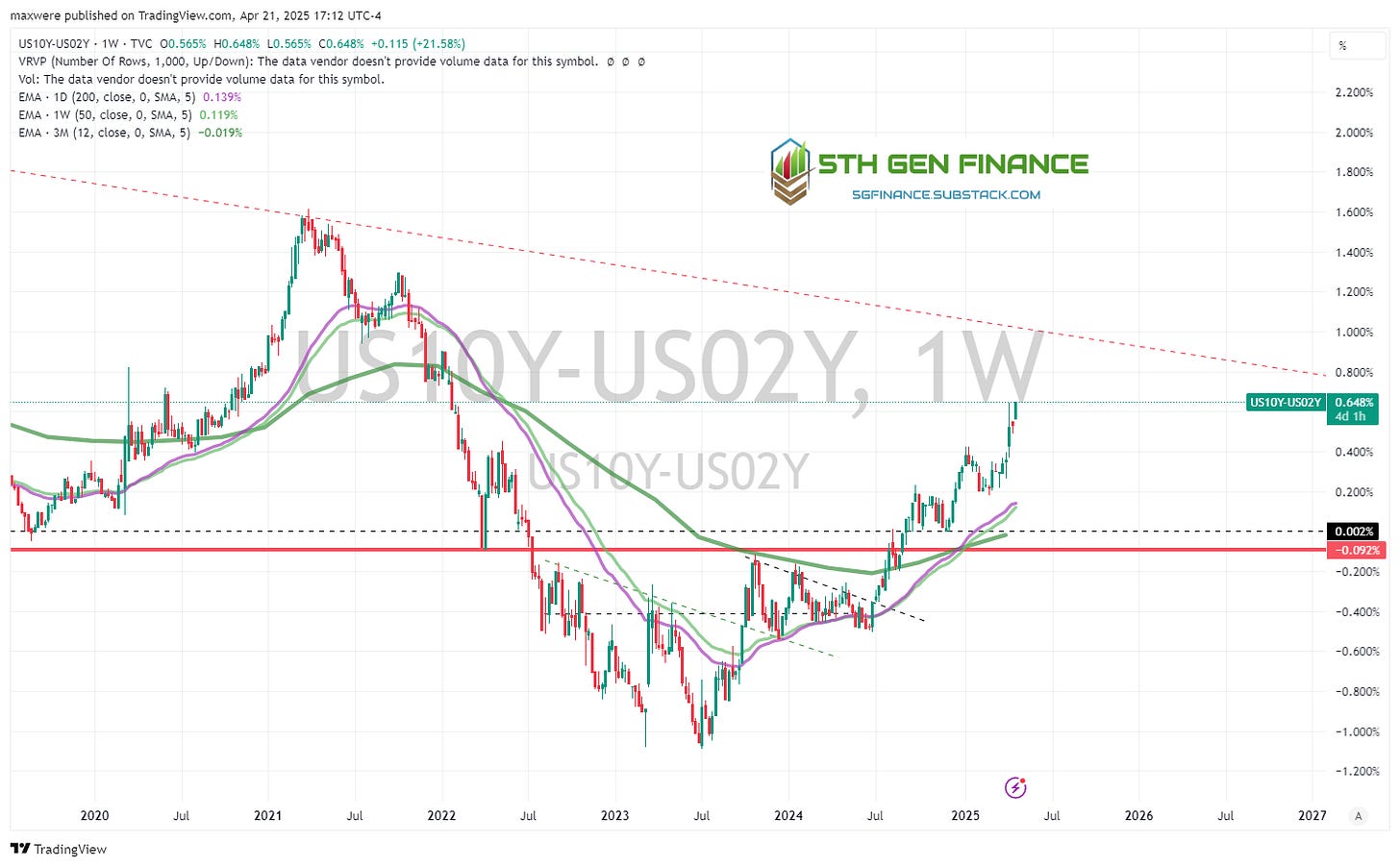

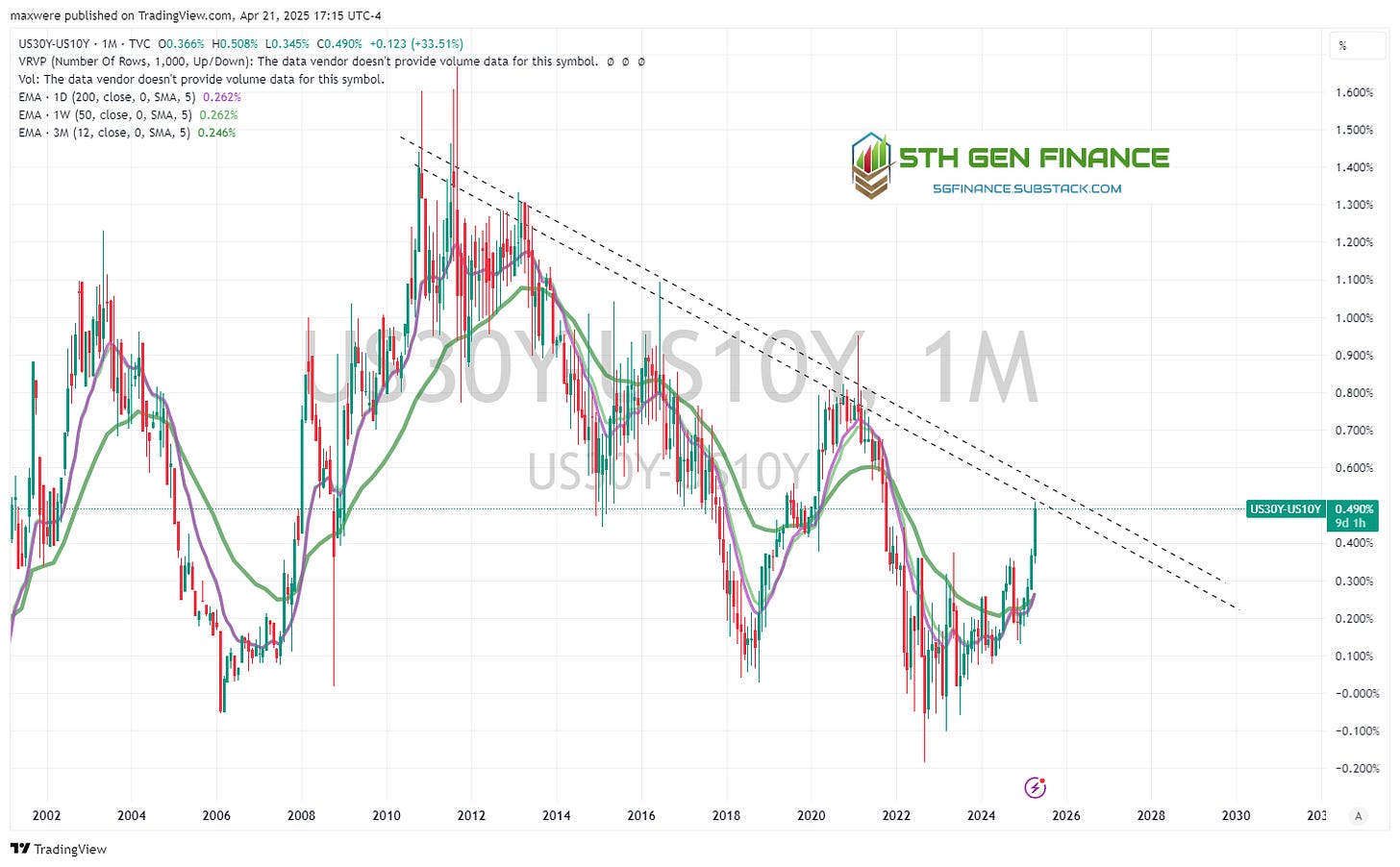

Financial Stress Point 3 - UST duration spreads

Def: Bear Steepener: https://www.investopedia.com/terms/b/bearsteepener.asp

A bear steepener is the widening of the yield curve caused by long-term interest rates increasing at a faster rate than short-term rates. A bear steepener is usually suggestive of rising inflationary expectations–or a widespread rise in prices throughout the economy.

US10Y - US 3 month is very bullish in favor or steeper duration spreads…

likewise with the 10-2 spread:

On a longer timeframe, we see the 30-10Y UST wanting to push through key downtrend. Does this continue?

US Banking Equities - Early Indicators of Distress

Financial Sector (XLF) - rolling over, but not materially different from broad based equities yet.

Regional banking (KRE) - rolling over, but still above major trend lines. A downturn is nearly assured. A crisis is not from this chart alone.

Bank of America (BAC) - very bearish (still early)

Banks look weak, but not insolvent. If this is part of a larger crisis, I would conclude we are still early.

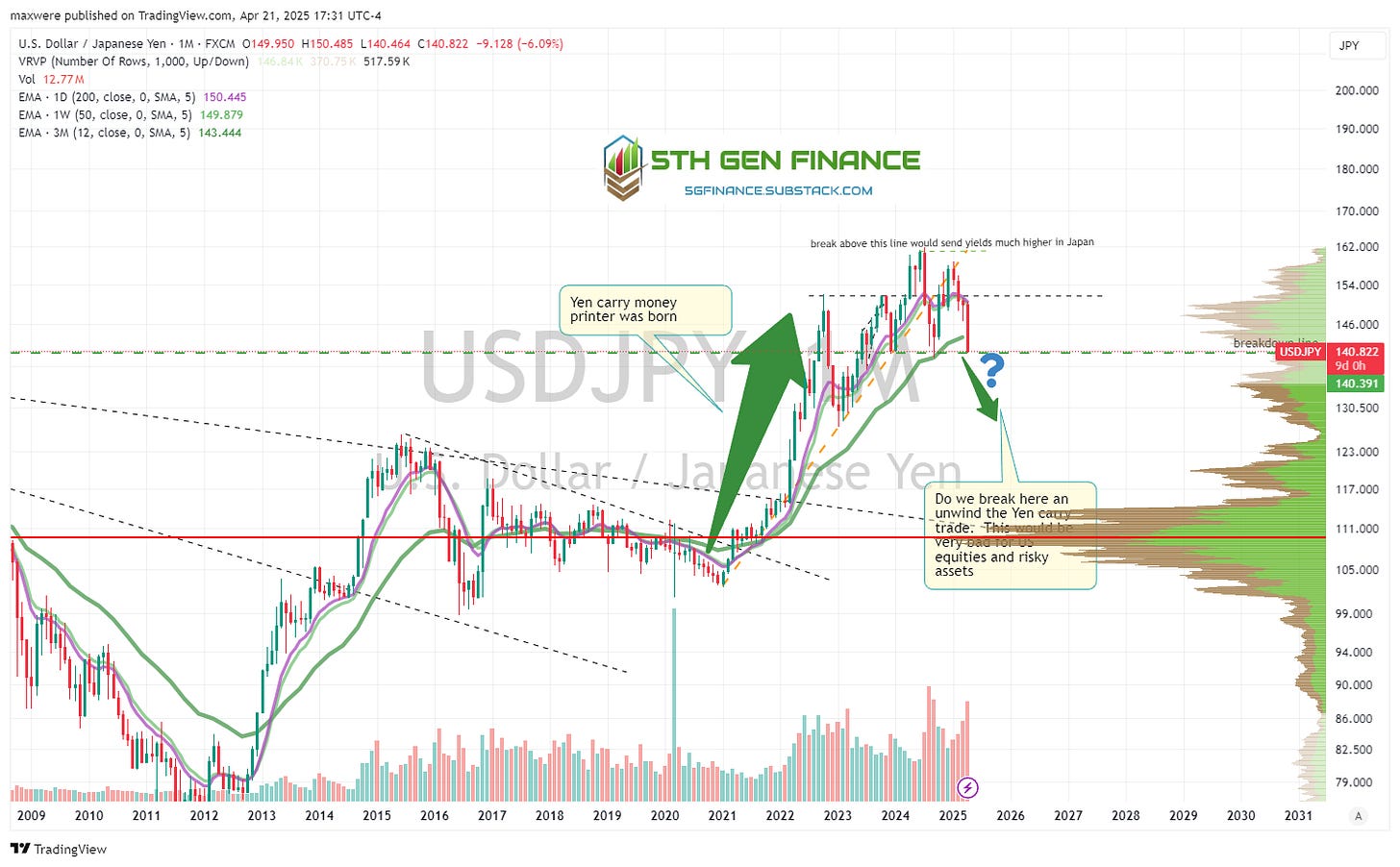

FOREX - Follow the Money

USDCHF - we are seeing a significant break down in the usd vs the swiss Franc (with volume). This is a good sign for precious metals. I’m not sure this represents a possible black swan event.

USDJPY - on the other hand, we are very close to losing the $140 level on the Yen. The chart suggests a rapid decline to more historically normal levels on the Yen of $120.

Unfortunately, the Bank of International Settlements estimates around 1 trillion dollars exist as a result of borrowed Yen (looks at stock market bubble). A fast move down of 10-15% will lead to margin calls and a selling cascade. Unlike the other charts presented, this one could unravel again in the next few weeks. Short of geopolitical events… this may be the biggest black swan on the current horizon.

Attempting a forecast…

Does the next banking crisis loom right around the corner? The short answer is no. Though markets tend to operate under the dictum of “slowly, then all at once”. This current setup is likely not an exception. Are major positions that we can see breaking? Not yet, but set alerts as the levels mentioned here. These can act as trip wire that something has broken loose. If several break in a short period, you can bet there will be consequences to the global financial sector.

For now, we are simply in a broader tech and US equity bear market most analogous to the period of the early 2000s. The one exception is rising long end yields (an early 70s phenomena)