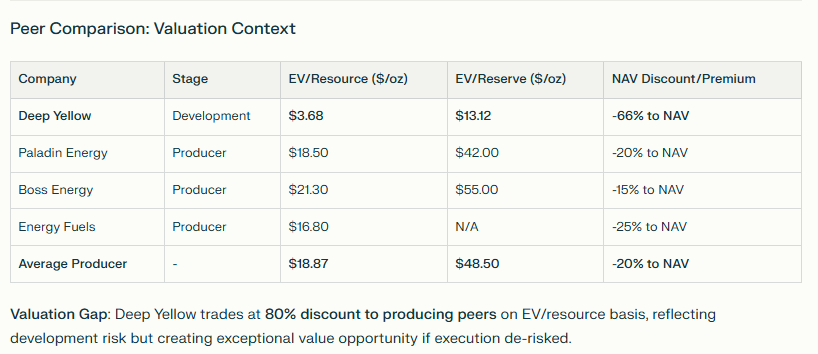

Deep Yellow on Sale?

John Borshoff steps aside as the CEO. Does the market reaction create a favorable entry?

The chart…

The news pulls the price back to the upward sloping trend line. RSI/DMA looks favorable for continued strength.

Deep Yellow Limited (DYL.AX): Investment Analysis

NAV-Based Valuation & Risk Assessment

Analysis Date: October 20, 2025

Current Price: A$1.89 (US$1.23)

Market Cap: A$1,839M (US$1,195M)

Uranium Spot Price: $78/lb U₃O₈

Executive Summary

Deep Yellow Limited (ASX:DYL) represents a compelling value opportunity in the uranium development space, trading at a 66% discount to conservative Net Asset Value despite owning the world’s largest uranium resource base among ASX-listed companies (381.2 Mlb U₃O₈). The company’s flagship Tumas Project in Namibia is shovel-ready with completed DFS showing robust economics, while maintaining an exceptional balance sheet with A$194M cash, zero debt, and a 34-month cash runway requiring no equity dilution for at least 12 months.

However, the sudden departure of CEO John Borshoff on October 20, 2025 introduces near-term execution risk, causing an immediate 18.8% share price decline. Combined with uncertain FID timing (dependent on uranium price recovery to $85-90+/lb), the company faces a 12-18 month value realization window before cash preservation pressures may mount.

Investment Recommendation: HOLD/ACCUMULATE ⭐⭐⭐½

Target Price (Conservative): ✅ A$3.14 (66% upside) ✅

Risk Rating: HIGH (Development stage, management transition, uranium price sensitivity)

Recommendation: Accumulate conservatively.

The comprehensive NAV report can be found here:

The information provided is for educational and informational purposes only and should not be construed as investment advice. All investments carry risk, and past performance is not a guarantee of future results. Trading options involves a high degree of risk and is not suitable for all investors.