Don't be afraid to sell into strength

Premarket up, what I'm looking to do.

Long work day ahead… fortunately profits!

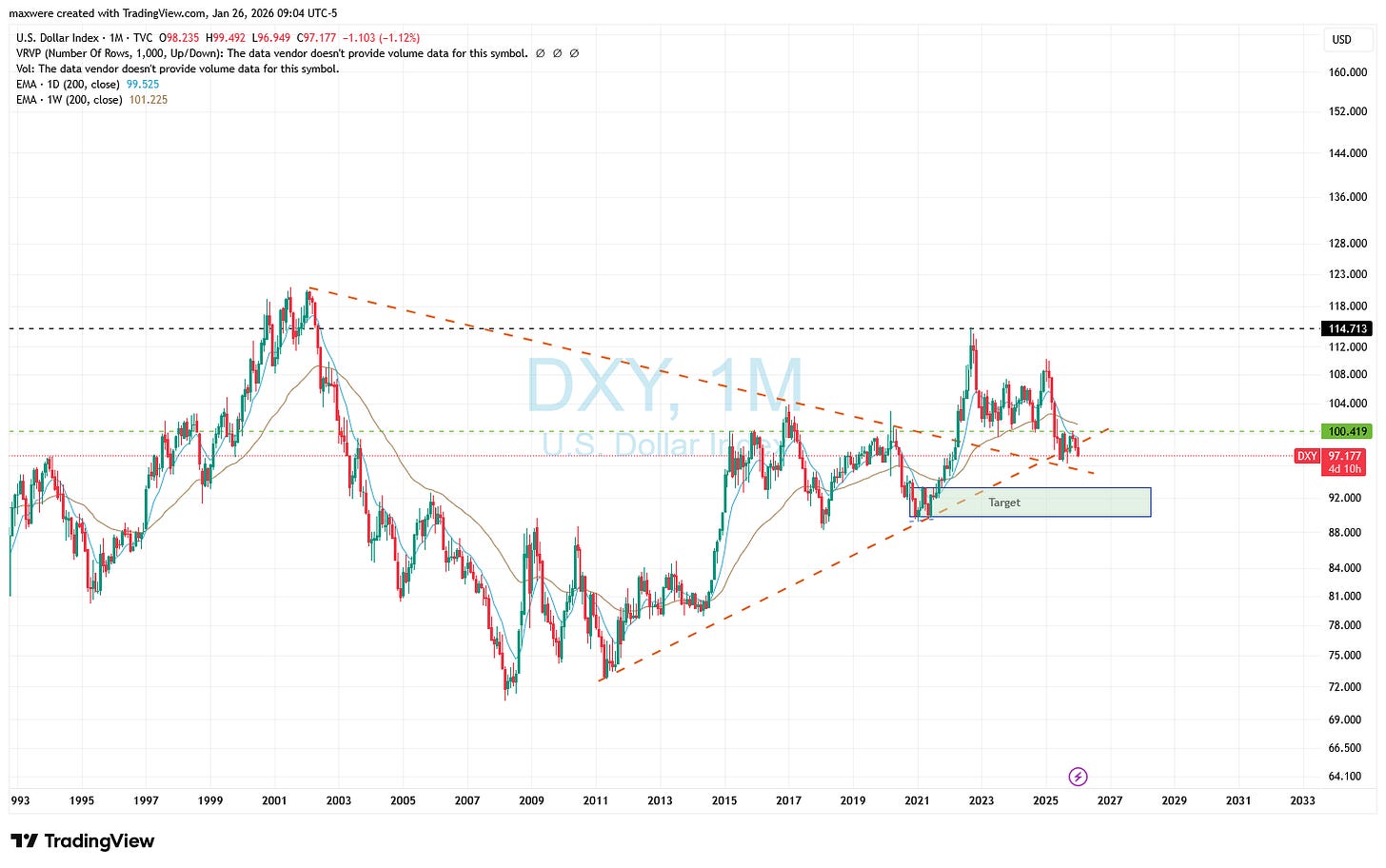

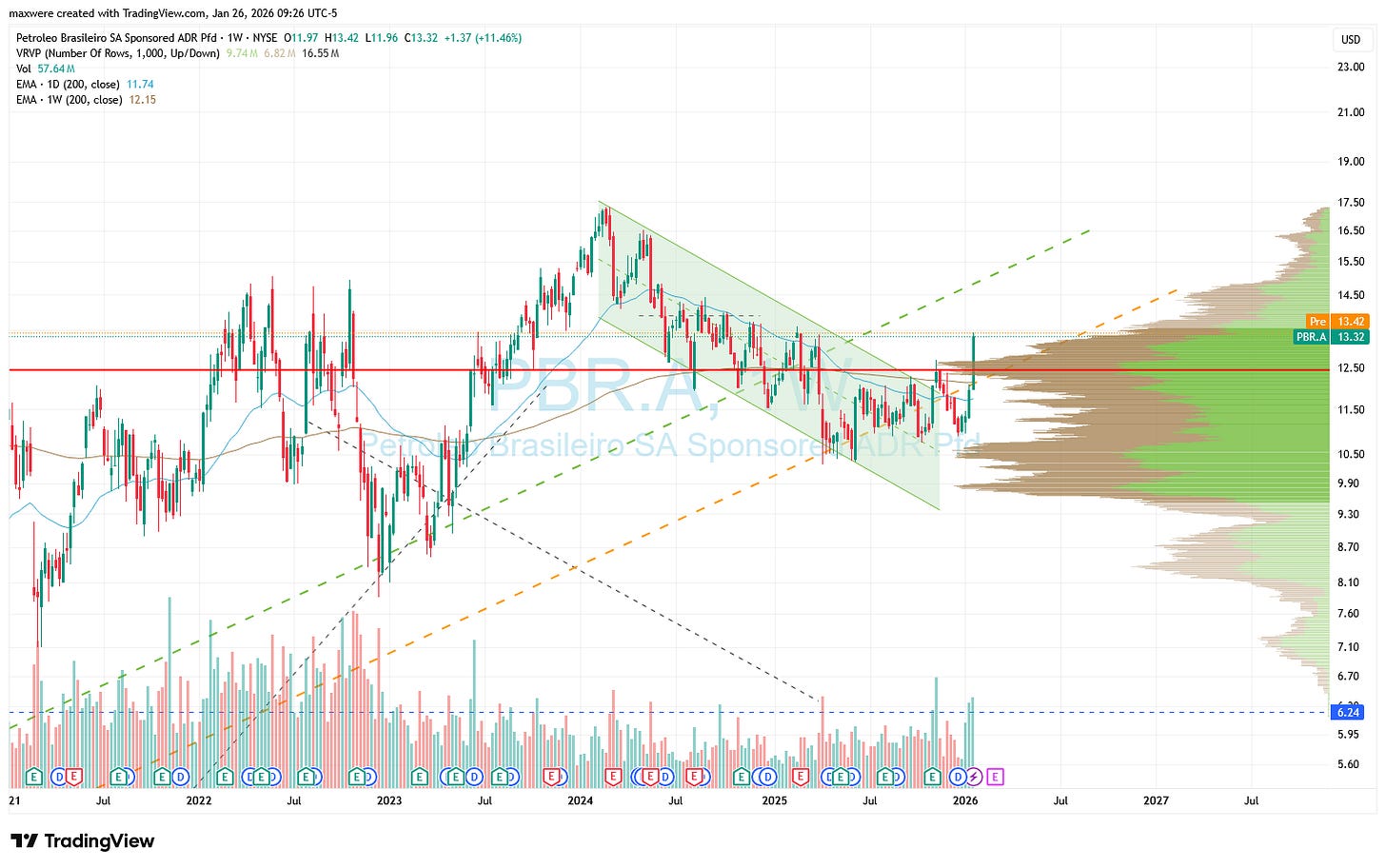

$DXY - we are losing the 10+ year trend line… 90s is likely very soon. Bullish oil, commodities, TEI 0.00%↑ , EWZ 0.00%↑ etc.

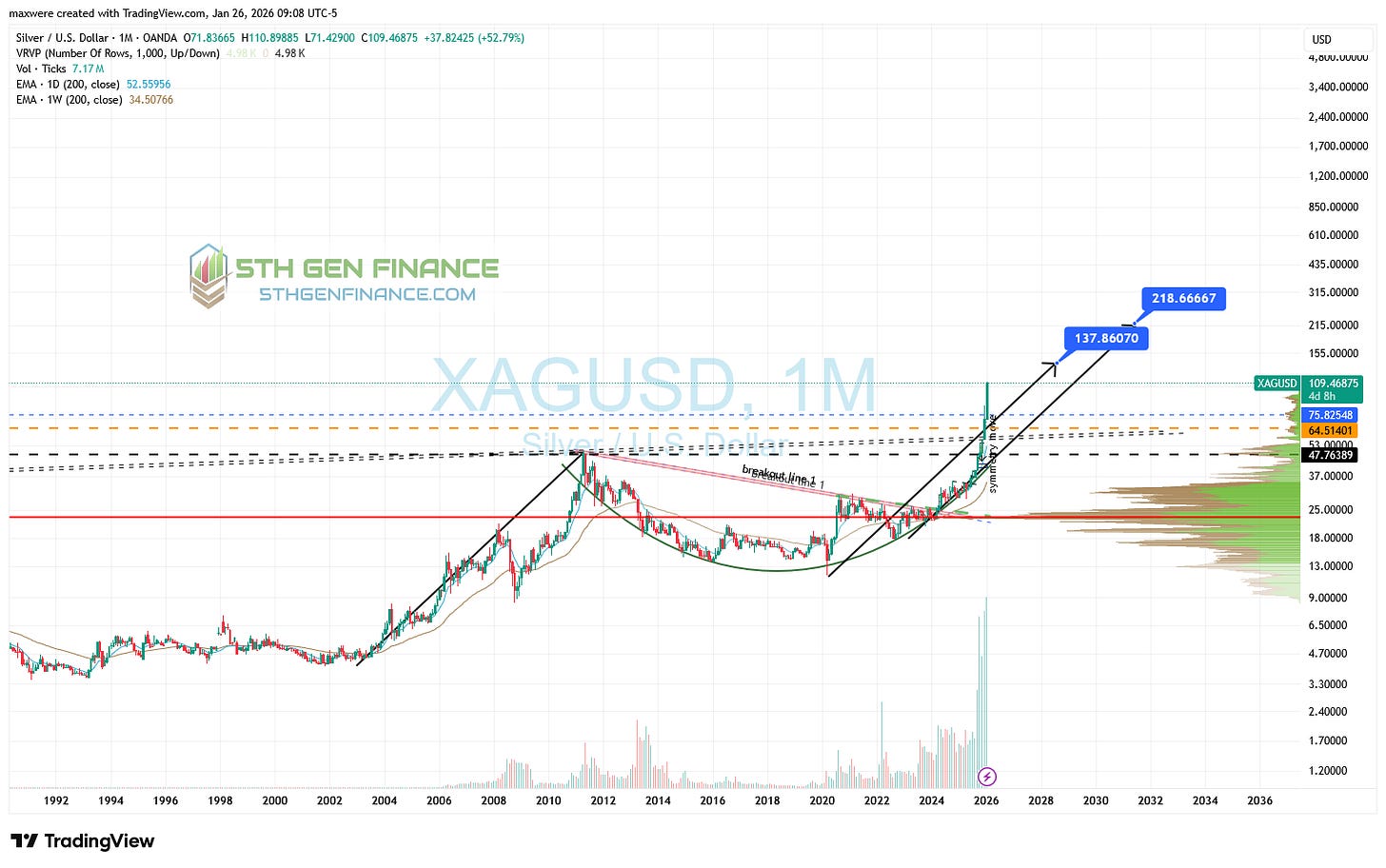

$XAG - WAAY over its skis. You can see the angle of the last bull measured move and how far ahead of it we are. Accept market generosity. For me that’s trim another slice.

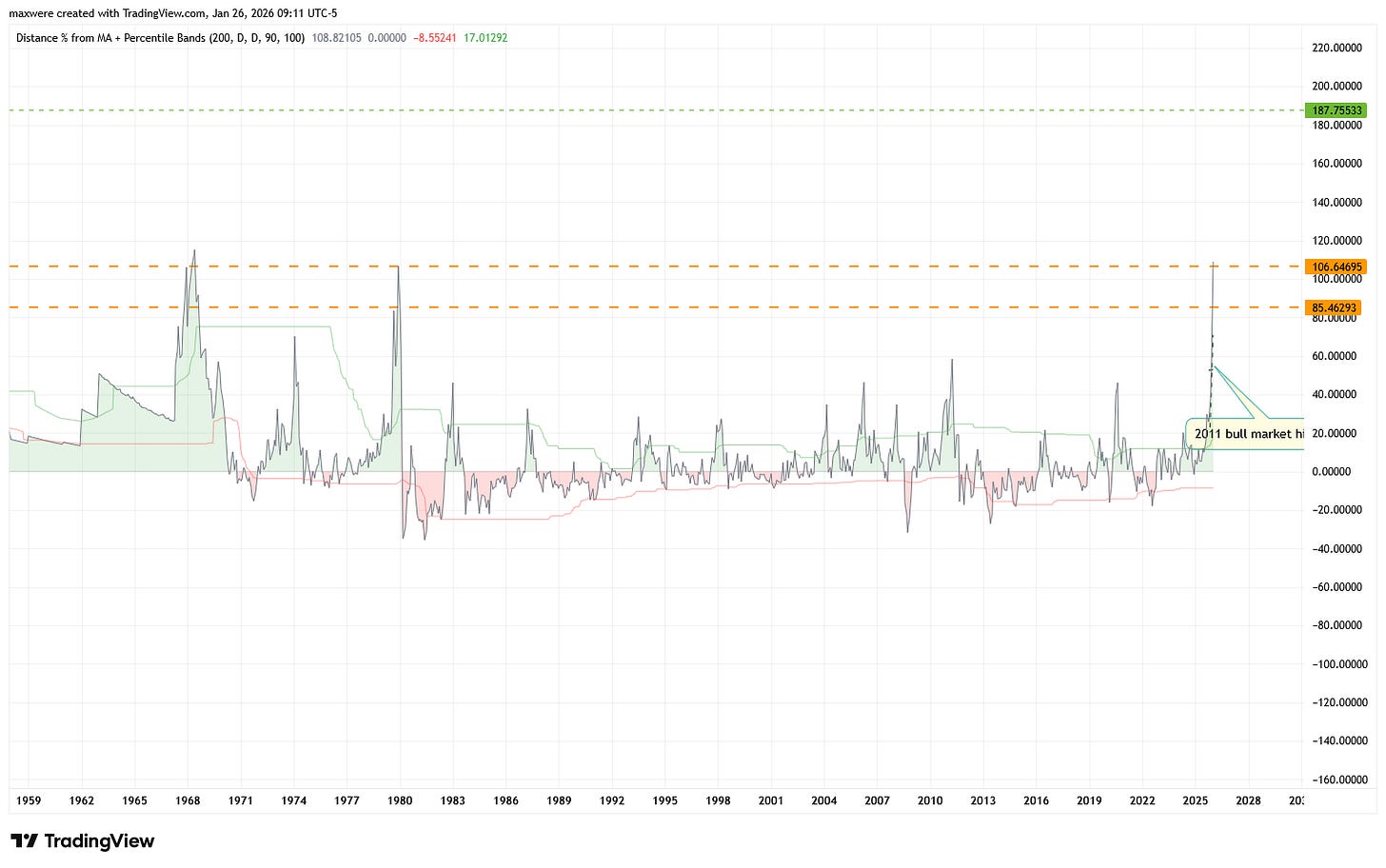

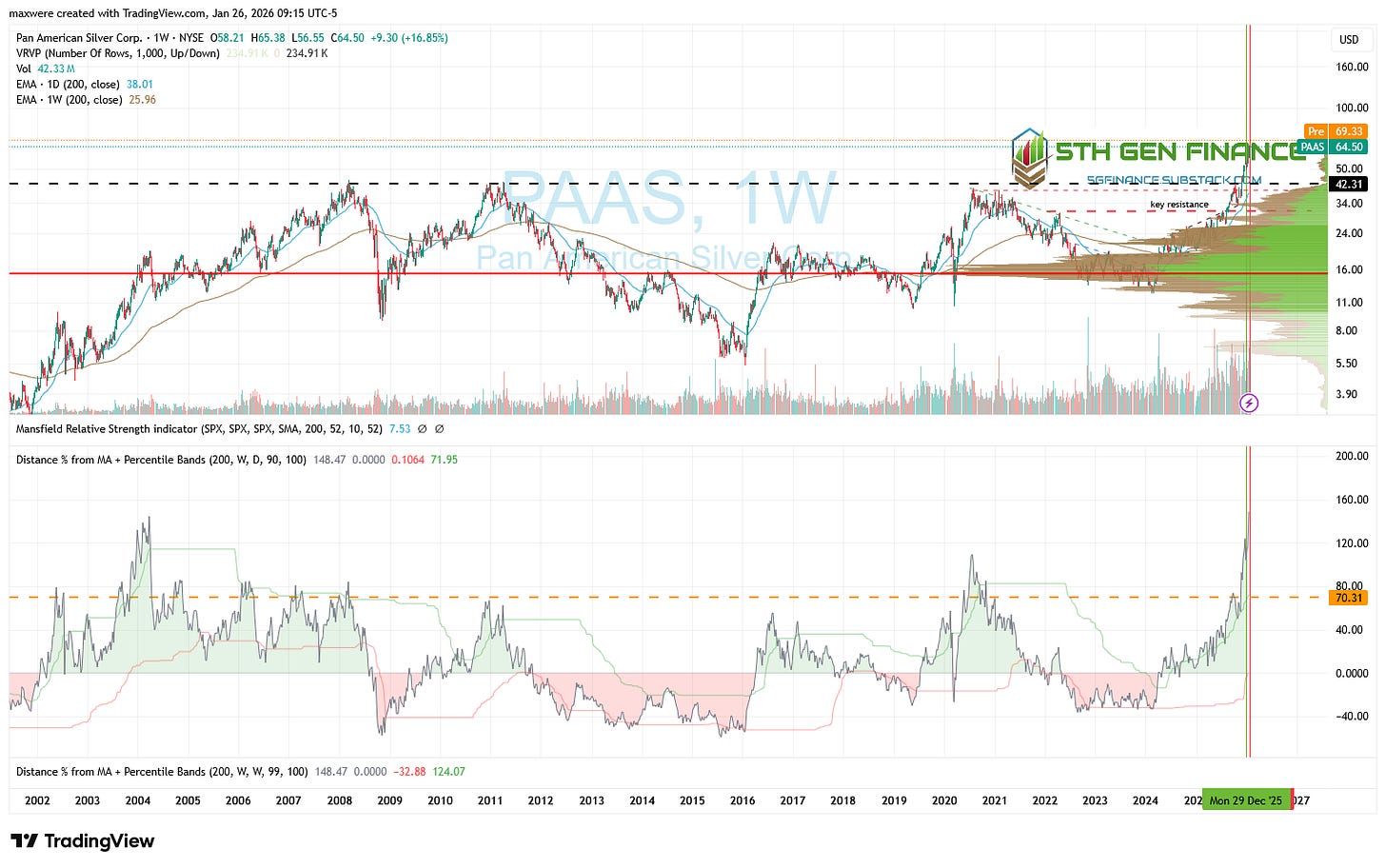

How much precedent is there for this parabolic move? None. Below is the distance from the moving average (price momentum). This is distance from 200 DMA. We have exceeded the Hunt brothers event… I repeat! This is the largest un-disrupted move on record!

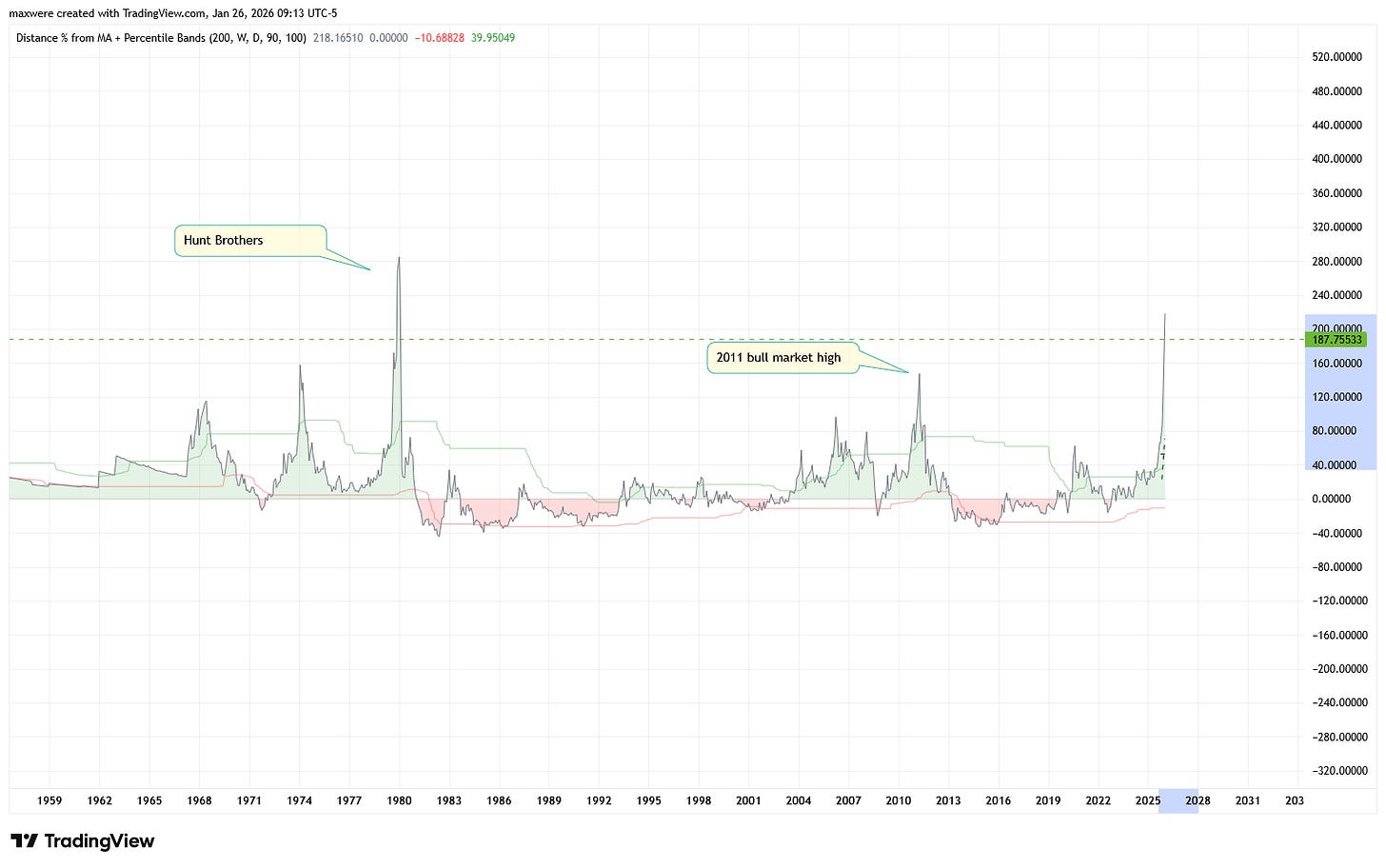

200WMA… Hunt Brothers still has it beat. But focus on the un-disrupted move

NEM 0.00%↑ Opens into overhead resistance

PAAS 0.00%↑ - all time high 200WMA resistance.

SBSW 0.00%↑ - 10-20% trim for me at $20. Option spreads coming off.

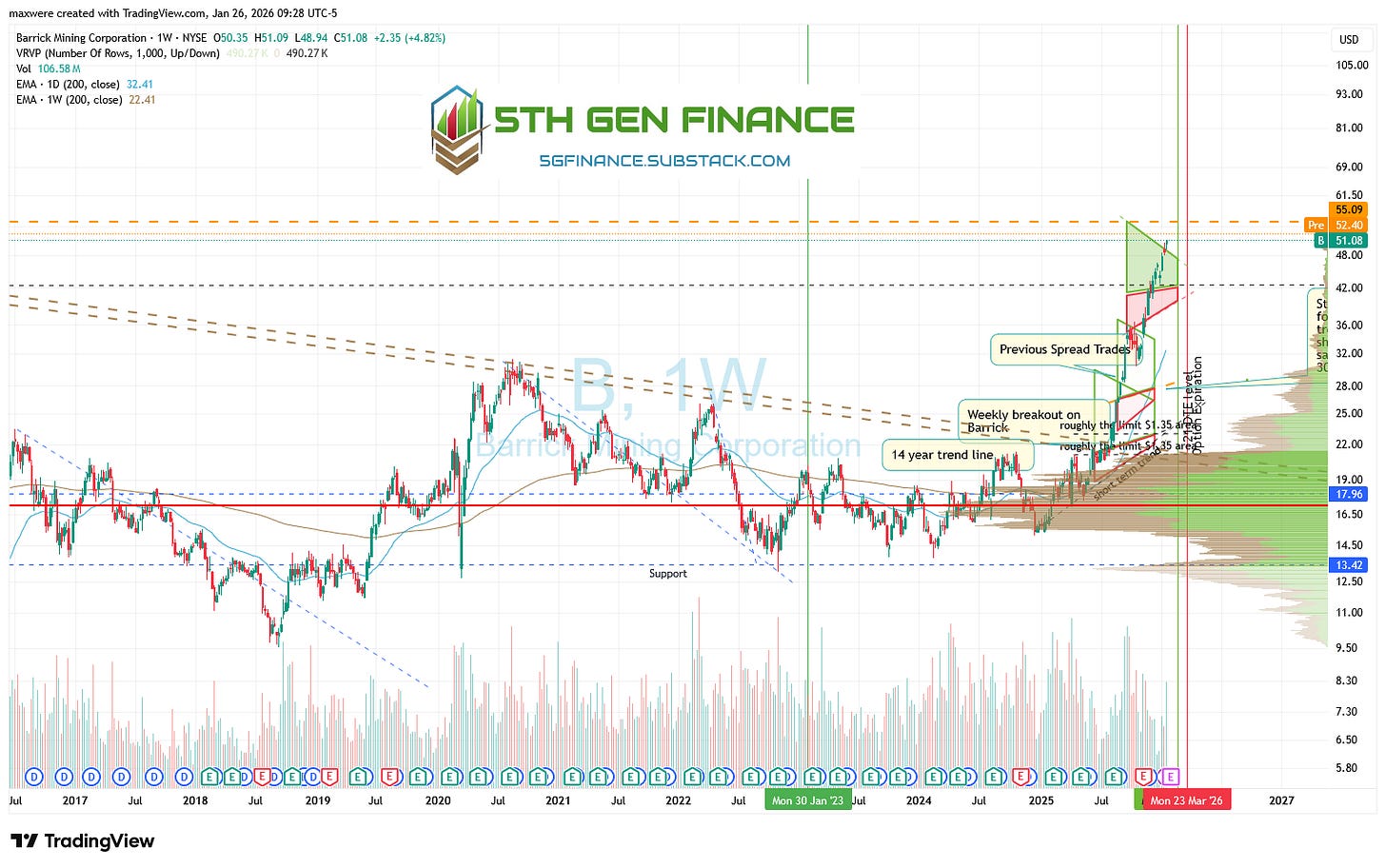

Closing the massive 3 roll B 0.00%↑ trade for +600%. B 0.00%↑ at overhead.

…just 3 examples. You can find similar on almost any of these stocks. Stay humble!

Where to shop. My list this week:

Oil and Gas

PBR 0.00%↑ - adding a bit on this move. Use PBR.A.

EQNR 0.00%↑ - new position… in the process of a breakout.

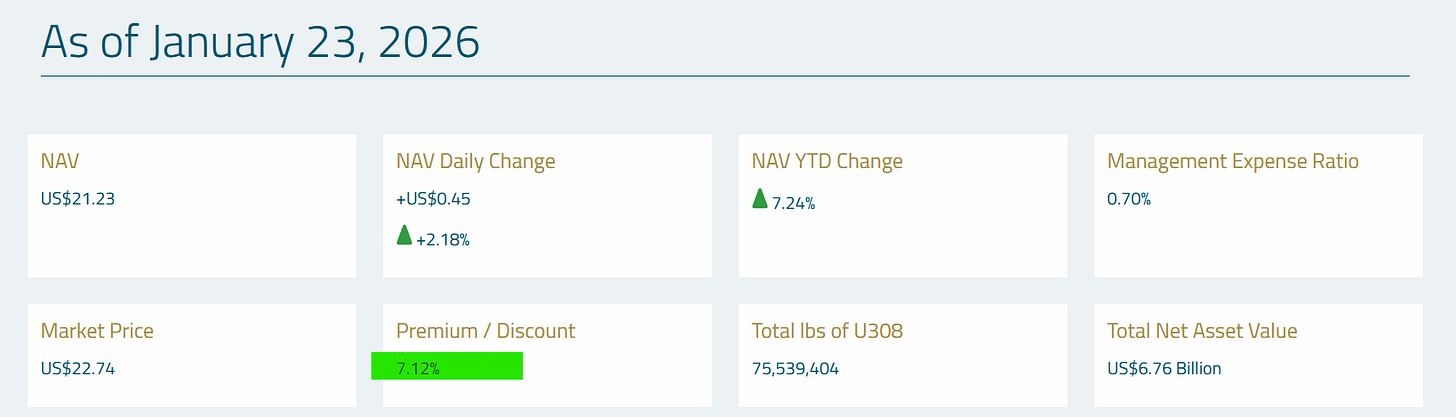

Uranium

ISOU 0.00%↑ - Head and Shoulders… target $21

Begining to outperform SPUT.

$SYHBF - Triangle Break out… continue to add

Even better against futures:

$LMRXF - Triangle Break out… add

URG 0.00%↑ - getting close to an starter!

$URNM/UX1! - Breaking out… sell SPUT buy miners

Sprott has massive surplus… they will bid up the price very soon. What you see in silver now, you will see in Uranium soon. Focus on where the puck is going!

The information provided is for educational and informational purposes only and should not be construed as investment advice. All investments carry risk, and past performance is not a guarantee of future results. Trading options involves a high degree of risk and is not suitable for all investors.