Gold has done its thing.

Time to go broke taking profits!

Apogee achieved. That’s the word of the week, right?

Gold is likely going experience gravitational forces in the near future. By virtually every measurement, there is strong overhead resistance near $3400.

Where does gravity bring us back to? Likely somewhere between $2700 and $3000. That’s a 10-20% retracement. In the weekly chart below, a pullback to $2900 would be no cause for alarm. There really isn’t a reason to see it as anything but a buying opportunity.

Gold versus SPX

Harvesting Gains

The following were trims for me this week:

Kinross - I have KGC at fair value based on today’s current price. With the expectation of gold pulling back, this stock is sure to bounce off the overhead channel. Position closed.

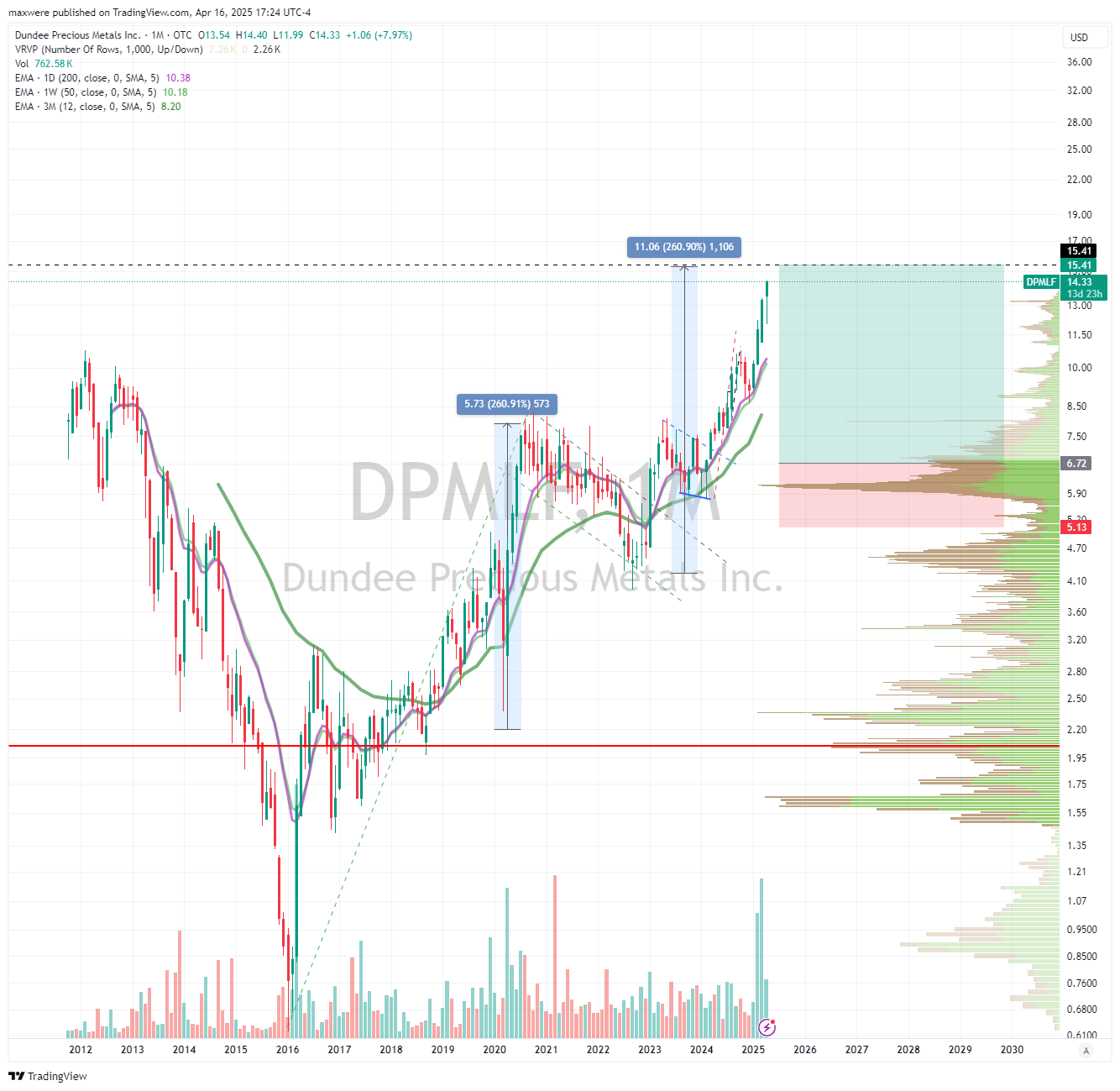

Dundee - I have a fairly greedy price target of $15.41. Close enough to trim the position. Sell half.

DRD gold - this is a tailings pile. There is reason to believe the stock could carry $30 with a continuing higher gold price. Instinctively, I believe SBSW 0.00%↑ will liquidate some shares (they own half the company) at this overhead resistance of $17. Look for a 30% or more pullback for re-entry. Position closed.

Discovery Silver - short term target achieved. Just a massive run. Closed half a position. I think this company is a take out. Most likely a large player, well know for open pit development, will purchase this asset. That may limit its upside on the stock alone. I wrote about this last year. You’re making close to 200% if you entered then.

Regis - RRL.ASX. I wrote a piece on this last year. The answer, of course, was yes.

Regis is close to at least closing half the position. I anticipate a pullback and nice reentry on this stock as well. 150% gain if you entered on my article.