Leverage, a Study in Options and Swing Trading

Back-testing vertical option spreads against one of the hottest swing trading platforms out there!

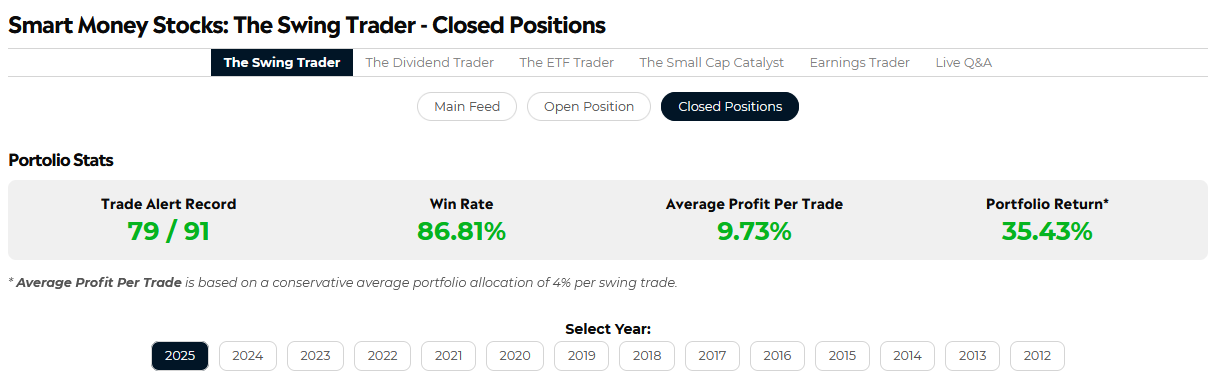

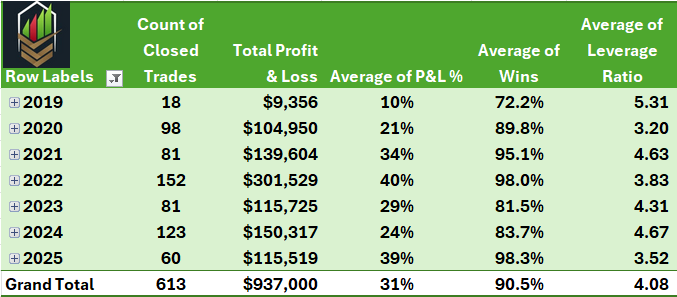

Gareth Soloway has done amazing work with his service. Just outstanding results! But are the sustainable? And are they extensible to a non-margin-able leveraged application?

DISCLAIMER - 5GF is not an affiliate or compensated in anyway by Verified Investing. This study is strictly powered by detailed published results on their site. To our knowledge these results are not independently audited from Verified Investing. If in some way they aren’t accurate, the results of this analysis would be in doubt.

Options trading involves risk. The following is presented for entertainment and education purpose only. Use at your own risk.

Purpose

Option liquidity is at an all-time high because of more retail involvement in the market. As a result, there would appear to be an opportunity to leverage high quality swing trading alerts with a sound vertical spread trading strategy. As a means of testing the effectiveness of well-placed vertical option spread, we chose to use Verified Investing’s detailed trade results going back to 2020 (the results go back further). In the back-test analysis we want to determine optimal parameters for the trade plan as well as gauge the profitability of the combined strategies over time.

Method

Using the Wisesheets API call for options, we pulled the nearest expiration date at least 90 days after entry and the implied volatility of the at the money option both an entry and exit (Verified Investing only provides the closed trades). From there we assume a Black-Scholes calculation of the position both at entry and exit. This was all performed in MS excel. Trades such as crypto, stocks with no options and stocks priced under $10 were removed before analyzing.

Black-Scholes used strike prices rounded to the nearest dollar. There may or may not have been an actual option available on that day at that level. The market won’t be as efficient as the Black-Scholes calculator.

Why Option Spreads?

Options allow exposure wanting as high of cost of capital. In general, naked option premium consume whatever value the leverage brings you. That’s why we’ve chosen to use vertical spreads in this test case. For many expensive stocks, the price is too high for purchases of 100 shares for a trade. In fact, it would be cumbersome to take every trade provided by Verified Investing with less than 100k without using margin. Furthermore, vertical spreads (without margin) are perfectly acceptable in IRAs. In fact, everything illustrating in this example could be achieved tax free! Yet another reason to use vertical option spreads!

What is a vertical option spread?

Vertical spreads are designed to leverage the direction of the movement of a stock’s price both in the long and short positioning. For the purpose of this analysis, we’ve limited the back-testing to Call and Put Debit spreads only.

I have consumed several paid education products and books… this video has almost all of what you need to get started with this strategy FOR FREE:

Initial Data Observations…

The data provided by the Verified Investing full results contain the average entry and exit price. Gareth Soloway clearly articulates his use of dollar cost averaging as a means of managing money and risk and entry and exists. The option trader may not realize as good of entries and exists due to nature of DCA, time spent in front of the screen and liquidity in the market at the time of trade execution.

The simulation does not consider assignment of the short leg of the option trade. We consider that to be unlikely.

We used implied volatility in the calculation of our entries and exists to simulate the trade (from historic daily close value). Realized volatility if you had taken a trade intraday, may have been higher or lower. We see this variance is somewhat offset in a large data sample size. The study does not consider any skill of the option trader at closing positions due to changes in favor or against the underlying position. Again, this is simply a level of detail that is beyond our ability to simulate.

Assumptions

Starting Account Balance: $100,000

Position size: $5,000

Risk Free Rate: 4.2%

TTM dividend yields where applicable

Option strikes rounded to nearest whole dollar

5GF vertical spread trading rules (supporting members)