Possible Option Setup on URA

This could be a 4-5x'r at a good price!

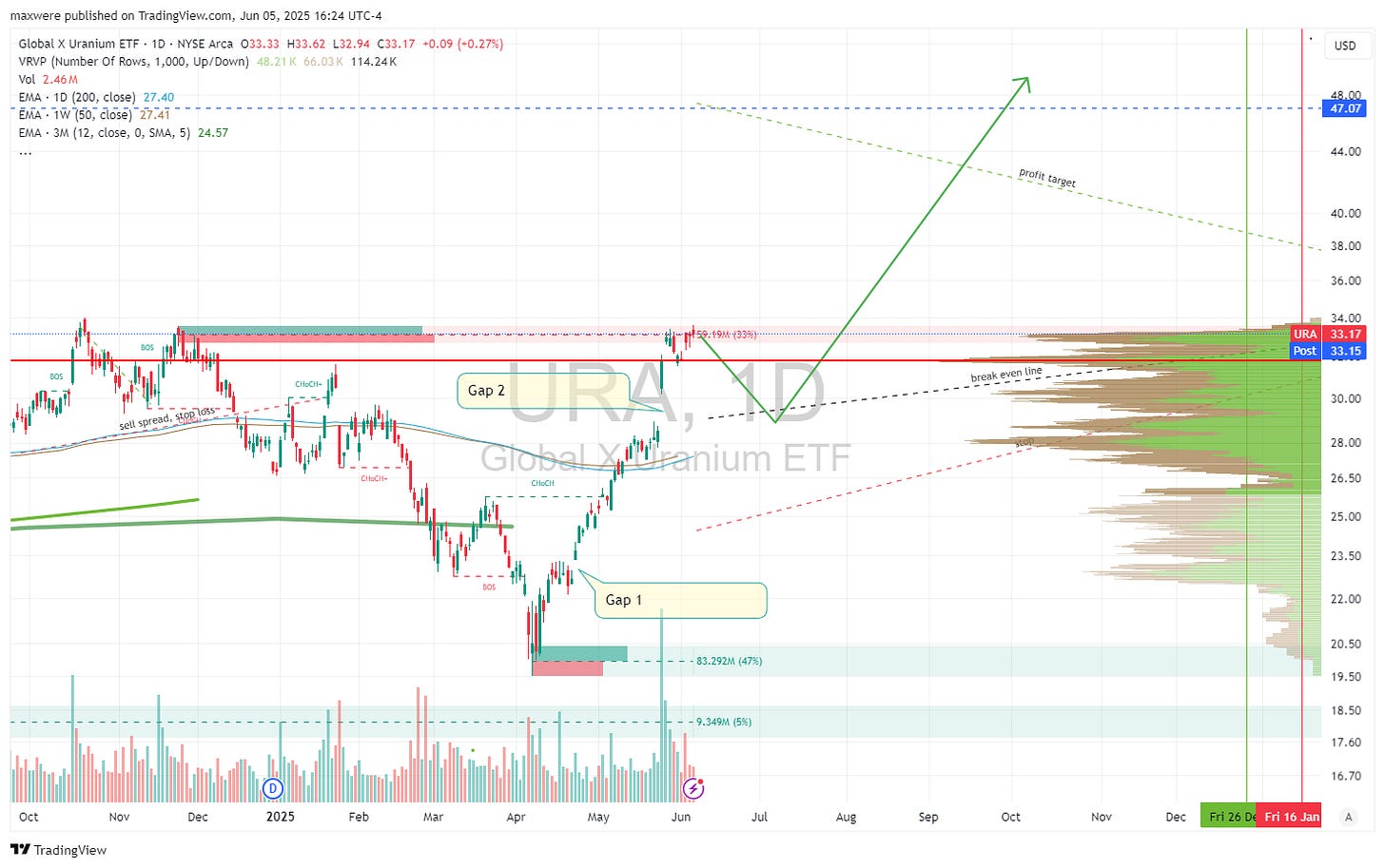

First the URA chart. The Daily chart has struck resistance overhead. Losing momentum, the likelihood that gap 2 gets filled is increasing.

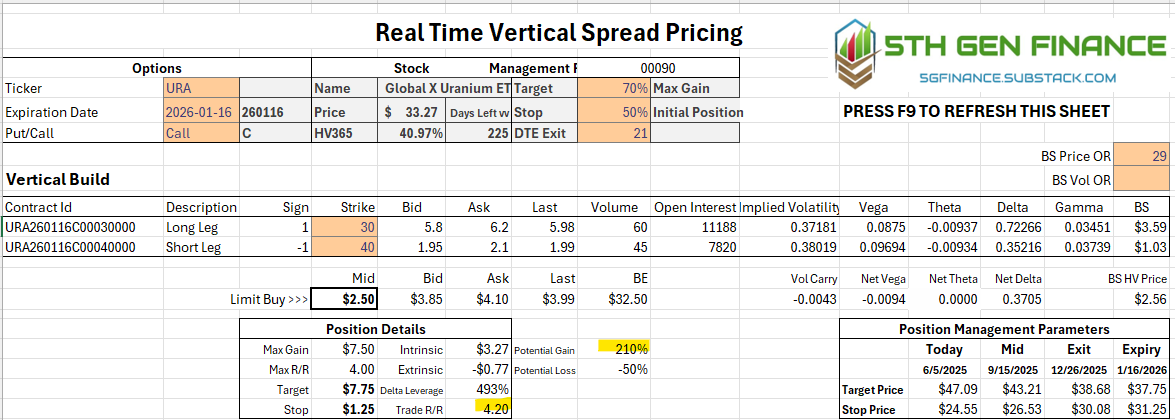

If gap 2 gets filled, my Black-Scholes model suggests the 30/40 Jan ‘26 call spread should reach near the price of $2.50. At this price we have a max profit of 210% and about 4x leverage to price of URA. Management plan is to stop at 50% loss and take profits at 70% of max gain.

Applying the management parameters the stops and targets overlay the weekly chart as follows…

First remember that this position will hit over its weight. 10 contracts = $2500. If you hit your profit the total spread will be worth near 8k. I suggest an initial half entry at the gap fill. There is always a possibility of a deeper retracement or even a right shoulder here!

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* Options trading carries a high risk of loss of capital. Trade at your own risk

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.

Should have said Jan '26 call spread.

Love these posts Robert where you are very hands on. Also always appreciate your comments over at NSBC, that's what brought me here.