Rushing out to buy gold or silver? ...read this first!

Let's chat.

Those who know me will probably recall my telling everyone who would listen to purchase physical silver under $25/oz for as much as they can carry. As of this writing we breached $93. What you will hear from me has changed.

While there are reasons to hold silver and gold an these elevated prices, short to midterm inflation hedge or speculative opportunities are no longer one of them. It’s time to look to other asset classes and “hard money” derivatives. What are the current risks with owning gold, silver and other PMs?

heavily overbought pricing in the short term - short term bias is to the downside. When will that start? $95, $100, $150? I have no idea and anyone else that claims to is a liar. Current physical markets are structural supply problems with bullion banks meting deliverable demand. The thing with banking history is this… rules get changed in the middle of the night.

high daily volatility - no one wants to have a retired client open their portfolio after a -6% silver day. Those days are coming. Forget the recent 30-50% moves. Short term volatility cares emotional overhead when dealing with client expectations.

Wouldn’t it be nice to reset the pattern back to $26?

Markets are discounting mechanisms. Stock markets. Bond markets. Currency markets.

Emerging markets have been fully (150%) discounted for currency risk for some time. This is a currency issue. It’s the US and first world bond markets that will experience market discounting cycle over the next few years. That is what we believe gold and silver and signaling to this point.

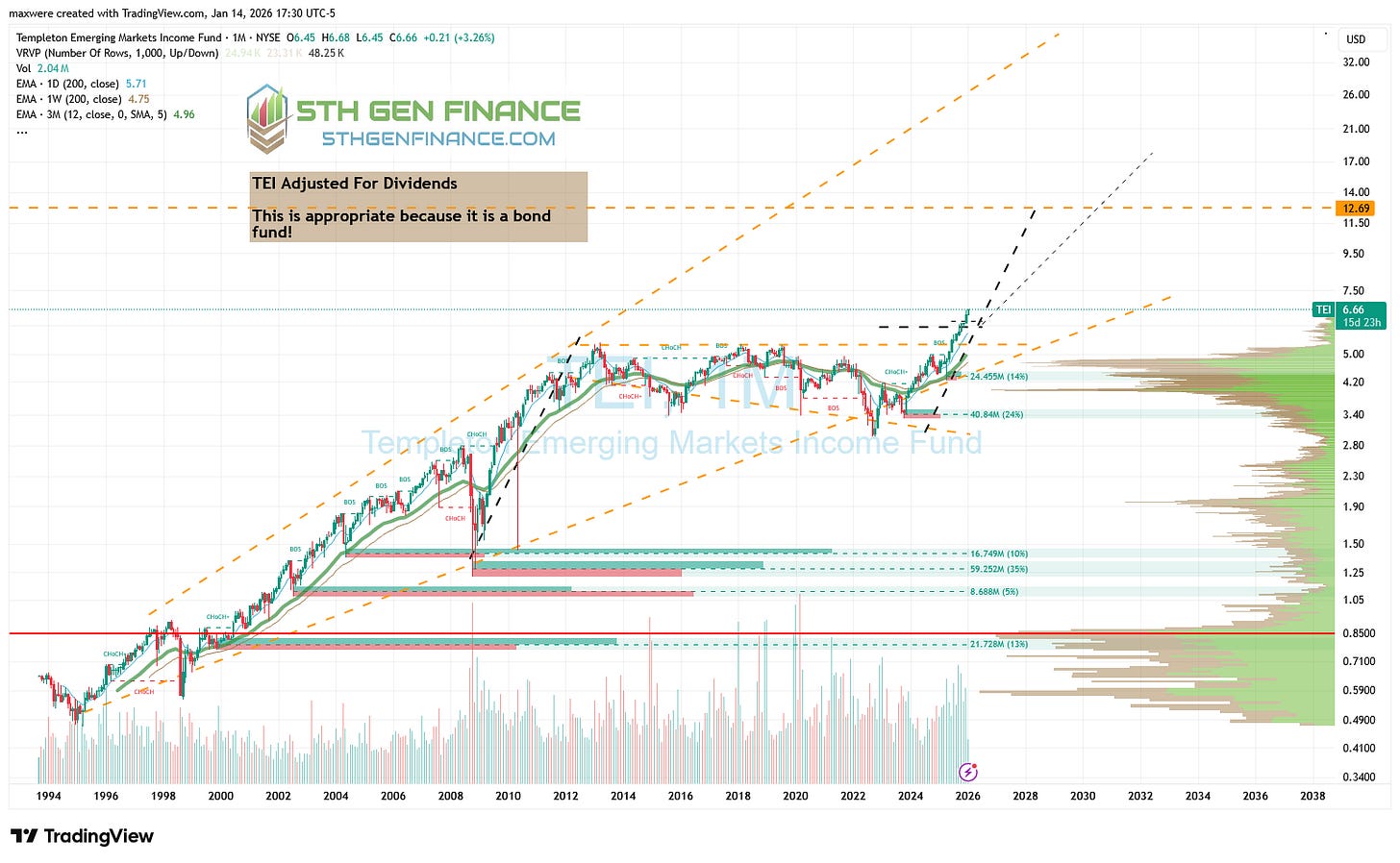

We have nearly fully deployed to TEI 0.00%↑ from mostly silver sales (5% is full deployment to a fund like this). I covered this fund in depth here. It’s still relatively cheap.

ETFs and other funds create a certain complexity when tracking against level one indexes. I have created a list of the correlative components I use to track the fund.

The information provided is for educational and informational purposes only and should not be construed as investment advice. All investments carry risk, and past performance is not a guarantee of future results. Trading options involves a high degree of risk and is not suitable for all investors.