Silver & Platinum <18 month targets

Traders who "skate to where the puck is going" will find themselves far less exhausted than the market.

It should be obvious the yield on silver and gold are historically terrible. That’s the point of the road map/trade plan. Pay yourself income for being right!

General principles:

shift some positions from defensive (physical metal) to more aggressive (miners) now that the bull market is clearly recognized

position trimming shouldn’t be a large haircut. If silver was 10% of your holdings and its now 12%… sell the 2% at key levels. This will realize a self made dividend of 20%.

if the metal moves up or down, the stock will move up or down in these high volume markets 98% of the time. Don’t be a “Jabroni”, wall street isn’t looking at geology reports.

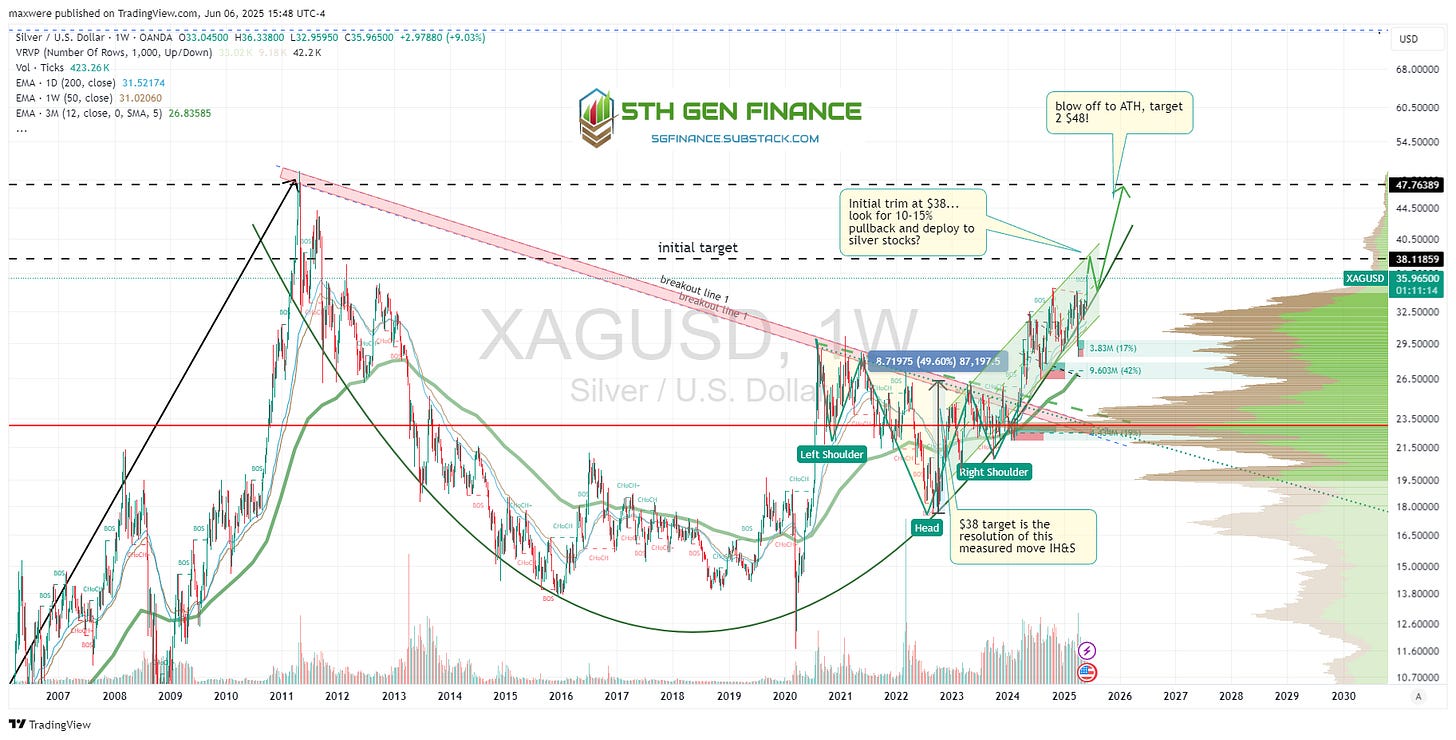

Silver Targets

The two structural targets on my mind are $38 and $48 respectively.

$38 target can be derived 3 ways:

it is the target of the inverse head and shoulders measured move

it is at the top of a parallel channel that begain in 2022

it recognizes an area that acted as support and resistance in 2011-2012.

$48 is a bit simpler, that was the highest weekly close of the prior pivot hight in 2011. (There is some case this could be re-evaluated to $45)

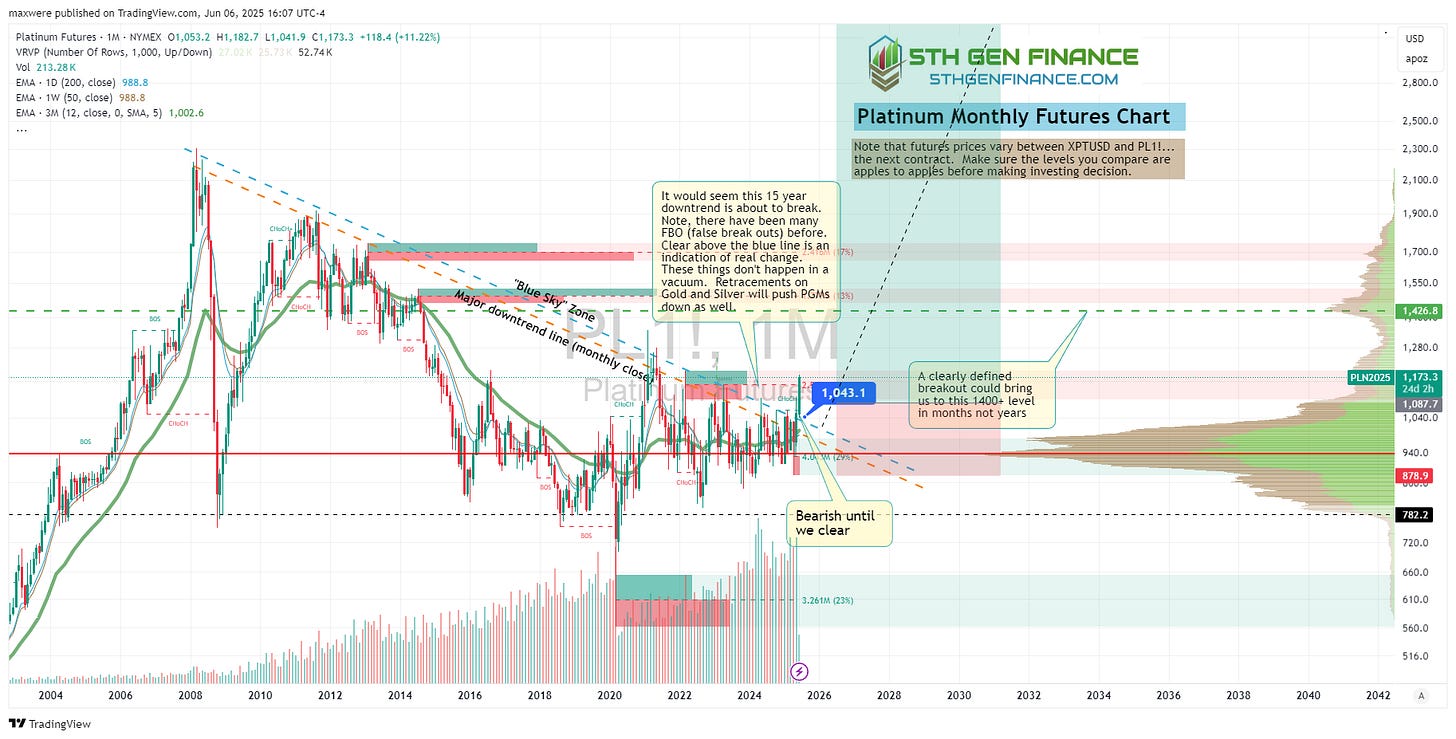

Platinum Targets

There isn’t much doubt, platinum has taken on a different era over the last few weeks.

This is my chart from a few months back:

As for targets, we should respect the obvious volatility and lightly trim at key levels with full commitment to get back in during some violent pullbacks. The chart below recognizes the previous significan support, now resistance of $1350. That would be level 1. Personally, a 5-10% trim might be all I consider.

Level 2 can be defined by the .618 fib extension of the inverse head and shoulders. There are previous liquidity zones in this area as well. That level is $1500.

Level 3 is probably $1875. The previous bull market recognized this as both major support and resistance during its blow off top. That is usually important during the next cycle. Finally, $2140 is major resistance top. I don’t think platinum will excede this level in the next 18 months. Over the next 5-7 years we may forget that it even existed.

Finally…

Get ahead of yourself. Get ahead of your emotions. You need the cash. More than likely, there will be more attractive opportunities elsewhere that are barely being discussed. Happy trading!

It try to retrace to the level of 31.600 and then up.

Update: trimmed the PGM portfolio by 8% at $1340 last week and will do again at $1500. Raise cash. Pay yourself a div.