The 5G Portfolio and Money Management Model

If you don't sleep as well as you should over the day to day performance of your stocks and portfolio assets, read on...

Introduction

If you're like most of the finance guys on Twitter, crypto maximalists, and you find yourself with a degree of sleep apnea around the day-to-day performance of your portfolio, chances are you've taken on too much risk. Also, judging by the general overall temperament of social media and finance, so does everyone else. Why such a phenomena? It could very well be because the discipline of money management is underdeveloped.

The problem isn't that stocks go down after you purchase them. This is simply a feature of investing. I'm of the opinion every healthy trade begins with a downturn.

Good traders and investors rarely buy at the bottom.

Learn from them… you shouldn't expect to either.

In the trading and investing courses I've seen, money management can be a bit of an afterthought. I hope to address this by presenting a simplified but dynamic portfolio architecture.

What are the risks we should be trying to manage?

Liquidity Risk

Toward the end of an after work happy hour, some 3 beers down, one of the former AIG FP officers (one of the organizations blamed for the 2008 GFC) told me quote “the credit default swaps and bad investments would have come back up in value if we could have just held on to them”. This may or may not have been true, but non the less is a sign of lack of liquidity. Illiquidity forces you to sell what you must not what you want. In this author’s opinion, most loses are the result of liquidity issues rather than market risk penalty. Liquidity risk can affect several ways. First, extended market downturns may create scenarios where you must sell at a loss to have access to capital. Second, personal change in lifestyle, employment, cost of living health and other factors should be considered in the pre-allocation phase of the portfolio construction.

Mitigation

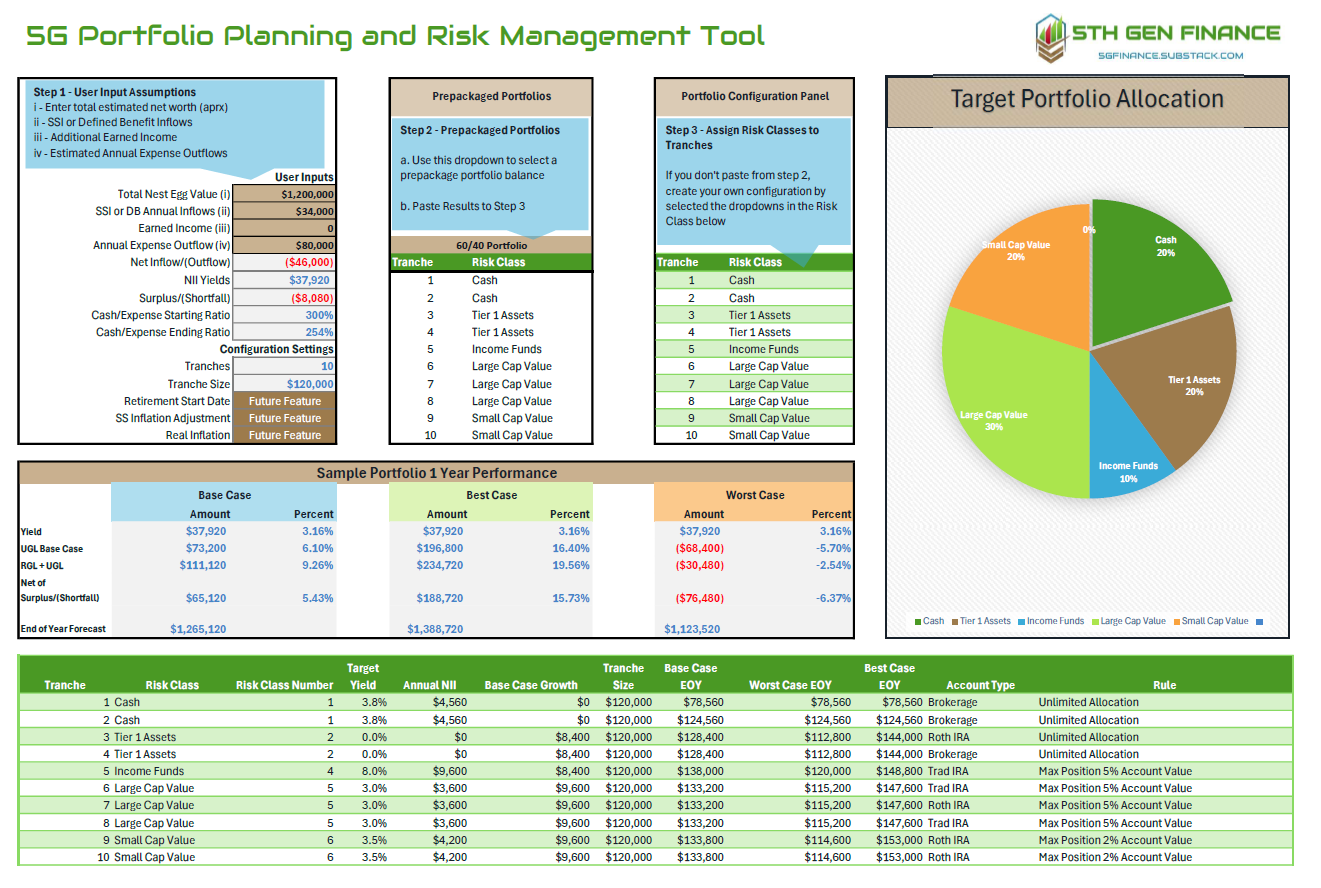

We mitigate liquidity risk through risk pools report or portfolio tranches. For the purpose of this illustration, we will divide our portfolio into 10 equal tranches (slices). To calculate tranche size, simply drop a zero from the overall size of your portfolio. (The choice of 10 is arbitrary and designed for ease of use. You can choose as many tranches as makes sense for your own construction. The following is meant to be strictly illustrative.

If we were to lay out the pools from 1 to 10 one would represent the most liquid (cash) and 10, the least liquid. Liquidity tranches are equal weight and specifically designed for your portfolio and its rules.

Market Risk

Every investment involves some degree of uncertainty. Market risk is the risk that your investment choices don't pan out the way you forecast at the time of purchase. Fraud, failure and competition is among the factors that can make your current asset investment be worth less in the future than what you paid. The ways that we mitigate market risk are twofold.

Mitigation

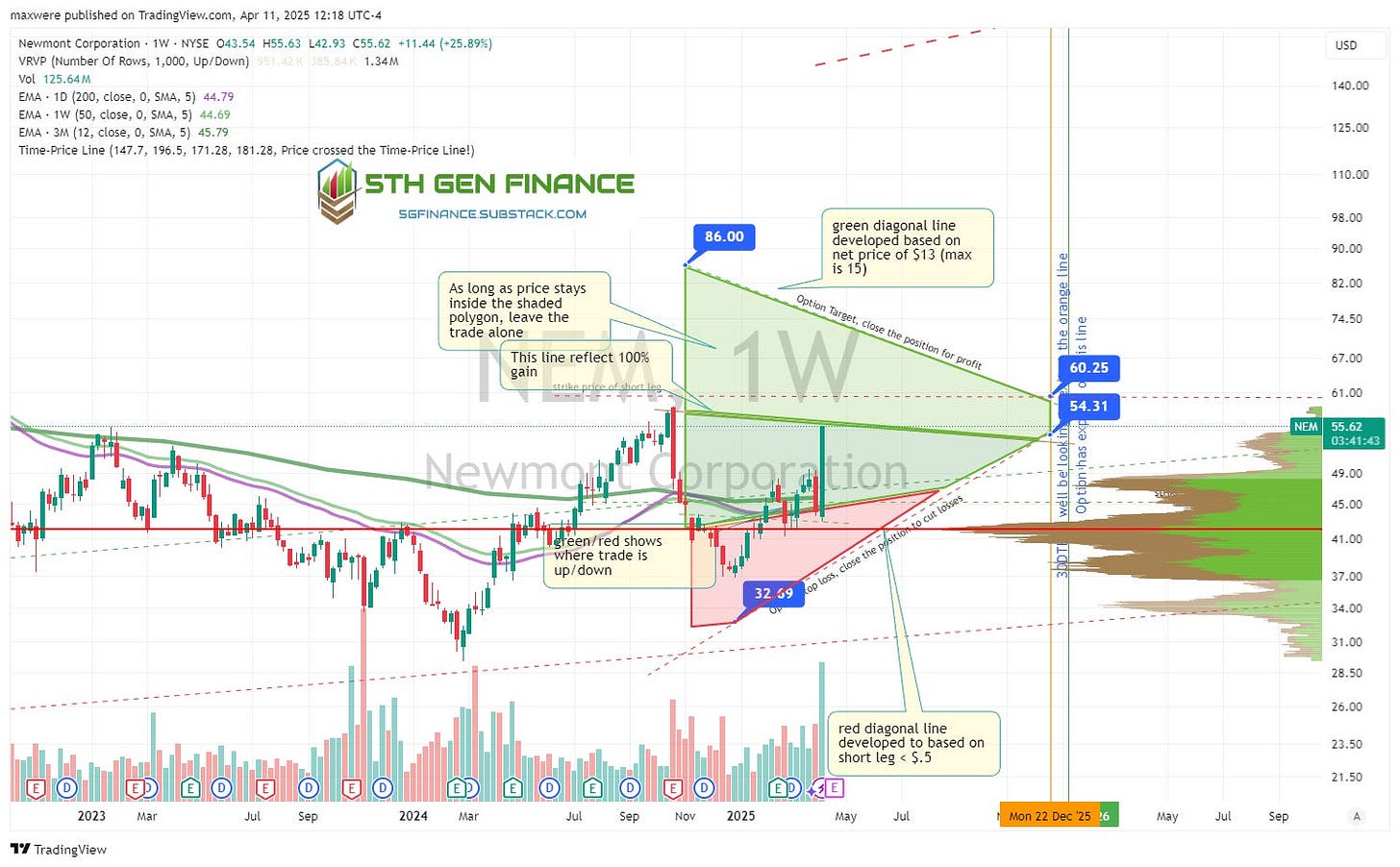

First, we use fundamental analysis and due diligence to determine a future price and the viability of the asset or company to achieve that price. This is done both at the individual stock and macroeconomic level. See the kitty model…

Second, we deal with market risk by diversifying both risky and non-risky assets. This is the essence of the design of the 60/40 or asset allocation portfolio currently popular in mainstream portfolio management practices.

Market Risk Classes

Market risk classes are a similar design. But, unlike liquidity tranches, market risks are designed to reflect characteristics of the market and investment choices.

The 5th Generation Model contains 8 risk class categories.

At the end of the year (or quarter) re-balance the tranches.

Practical Considerations

The portfolio management strategy is nothing more than budgeting concept. However, it will probably make sense for people to align their physical investment accounts with the general liquidity architecture. For example, if you have an IRA or 401k, they should be designated for higher tranches than after tax brokerage of bank account. Don’t forget your If you are a trader it is best to designate the trading account as separate account from brokerage account you need to draw liquidity from.

Subscribers and supporting members can download the planning tool and video tutorial below. Cheers!

Keep reading with a 7-day free trial

Subscribe to 5th Generation Finance to keep reading this post and get 7 days of free access to the full post archives.