The Best Trade Plan I've Ever Developed!

Commodity Accelerator Results So Far...

…posted from Friday, but it didn’t make the main feed.

Portfolio Results (9/5/25)

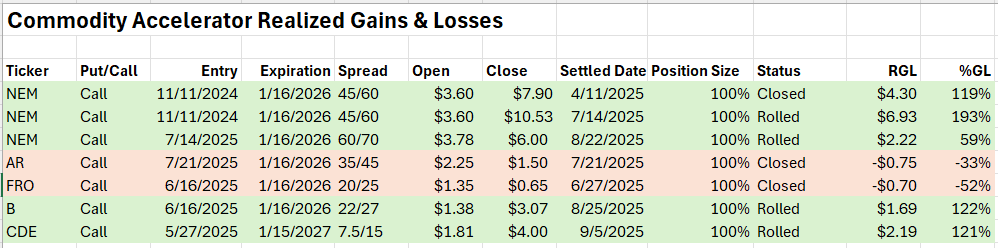

Realized gains make up a return of 75% profit. This was including 2 losses. Assuming you allocated $5000/full position, you would have booked $26k so far!

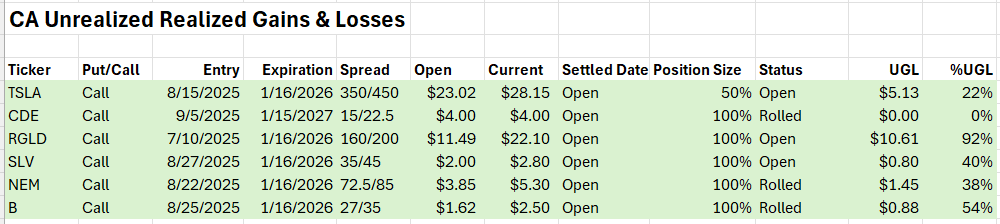

UGLs sit at about +43% unrealized gains. This accounts for just under $11k unrealized profits from an equal weighted positioning of 5k per trade (2.5k risk). Through roughly half a years exposure a 30-35k portfolio produced over 100%! This has been primarily due to the exposure in gold and silver miners.

!!!UPGRADE TO PAID SUBSCRIBER TO RECIEVE THE ALERTS!!!

Review the back test results from earlier in the year: