It's Groundhog Day! Thermal Australian Coal Breaking Out!

Take one eye off of the silver chart... Low risk entries are showing up!

We’ve been watching this for a while, we’ve had more than one fake-out. Lots of signs point to this being the real thing:

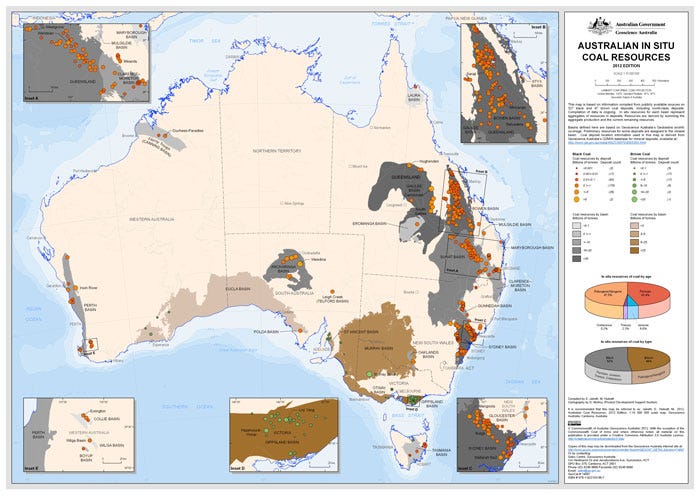

First things first, geography. Aussie thermal coal is primarily produced in Queensland and New South Wales. It’s destination is Asia, particularly south east. It moves there via Capsize dry bulk vessels. Remember that later as we take in the full breadth. First the map:

The pure plays are covered in more depth in the primary article. Lets just review the charts. First the futures market:

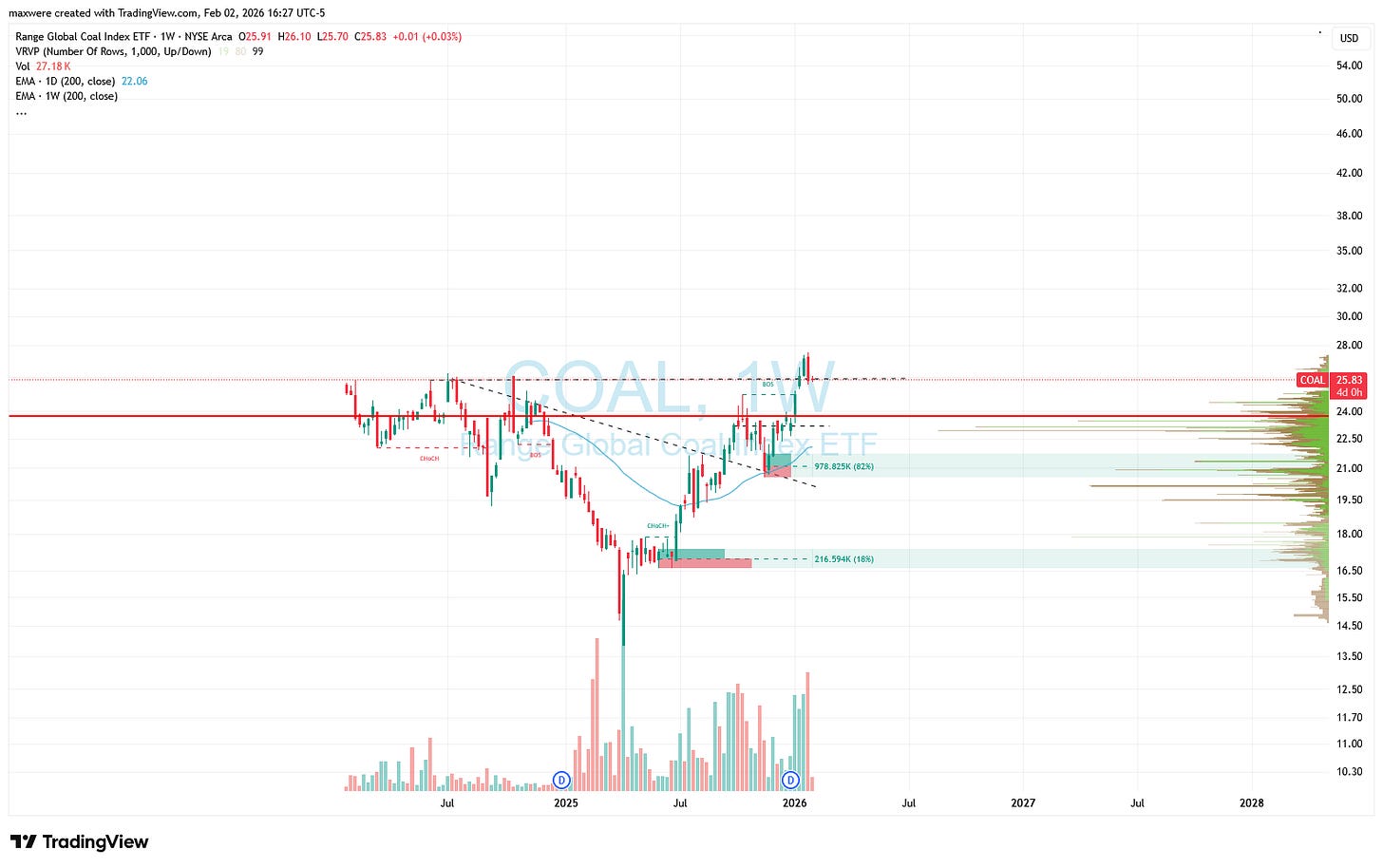

We are just breaking above water on Newcastle coal. This chart has a long way to go from an incredible base. Thermal coal is cheap!

Transportation

Demand for dry bulk shipping rates has already printed a signal:

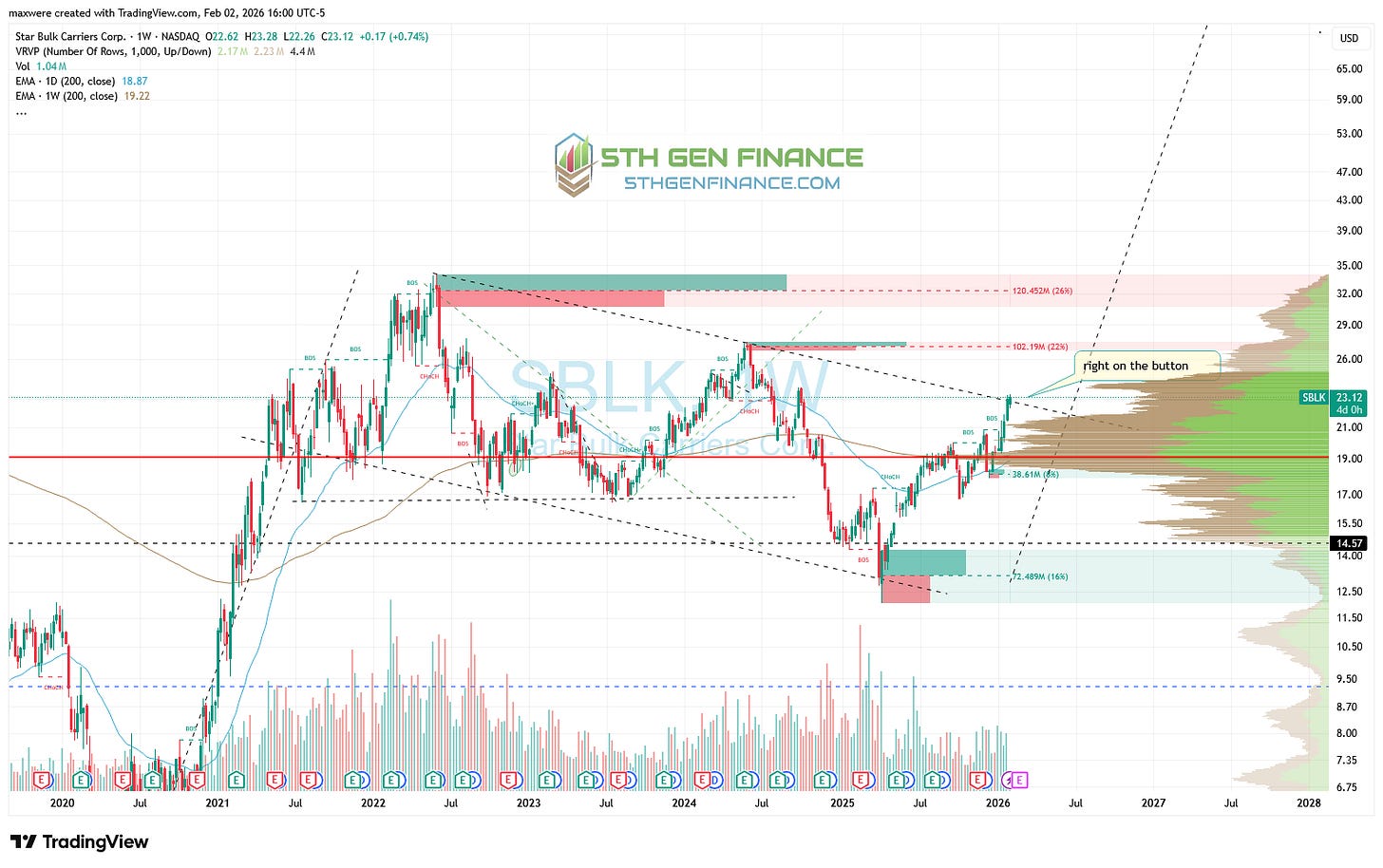

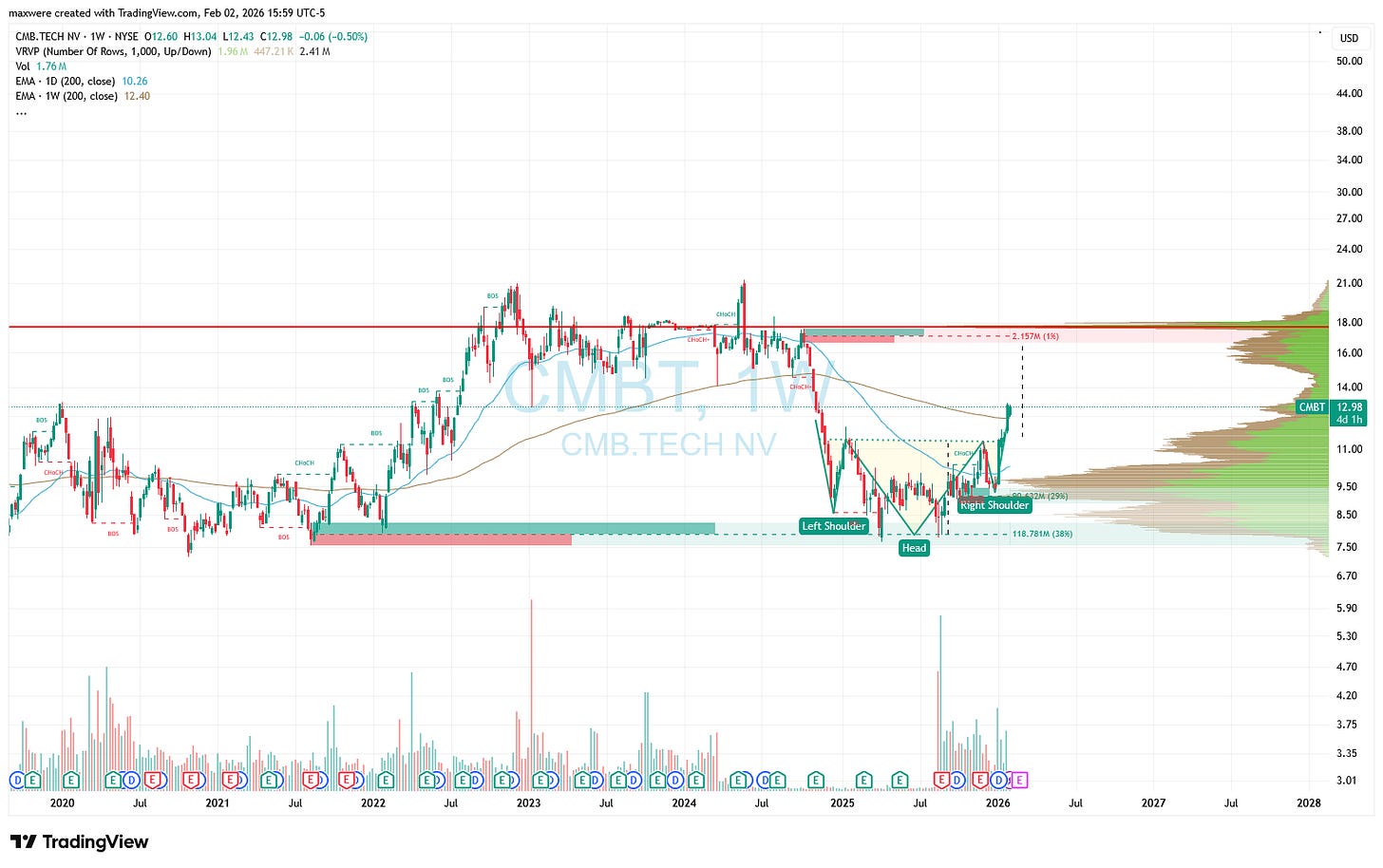

Remember capsize. The companies with the largest capsize exposure happen to be SBLK 0.00%↑, CMBT 0.00%↑ and GNK 0.00%↑

Right at the downtrend!

Midway through an IH&S!

Exactly as SBLK 0.00%↑ but slightly more pronounced!

The Miners

All of these stocks trade primarily on the ASX, so evening session will tell the tale.

Massive bull flag on WHC.AX being confirmed. We are adding positions here.

Adding small positions with lower time frames and the market breadth. Not a big breakout yet!

NHC 0.00%↑ is very similar to the transportation companies. $4.75 AU would be compelling. This may be the week.

What To Expect From A Bull Market (Asian Coal)

A fully confirmed bull market suggests an equal weighted portfolio of the above should return 250-400% with 6-8% yields over 18-24 months from a resumed breakout! This is speaking strictly from the chart setups and historic profit sharing of these companies. One thing is for sure, we are still very early.

Other Thermal Markets

AMR 0.00%↑ is getting more attractive. $185 is a desirable price, but we might need to start positioning here.

CNR 0.00%↑ (Formerly Consol) is experiencing a backtest here. We are accumulating at these levels

BTU 0.00%↑ with an attractive pullback. Might add to some current positions.

COAL 0.00%↑ , still a very new fund. Back-testing the issuance levels. IH&S in play. Given the evidence so far, I would consider this fund to play out like a basket of the above. Buy COAL to keep in simple.

The information provided is for educational and informational purposes only and should not be construed as investment advice. All investments carry risk, and past performance is not a guarantee of future results. Trading options involves a high degree of risk and is not suitable for all investors.