Yes, You DO Want A Traditional IRA In Your Portfolio Stack

There are two ways to get your ROTH IRA fully funded, and one is whole lot better than the other.

“Volatility is the price of admission to a bull market” - SilverChartist

You don’t need to search long to discover many financial advisory articles recommend opening a Roth (perhaps for multiple family members) and contributing every year as finances allow. This is good advice. I need not illustrate the difference between 20% growth tax free and 20% growth tax deferred can net you. In spite of the latest rumor from the Whitehouse, if you are a US citizen taxes are in your future. Best deal with it now.

Front Door Funding

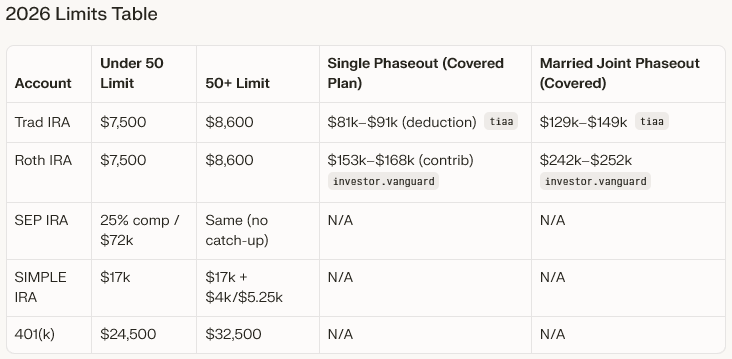

The limits…

Note that the Trad, SEP and Simple are pretax. 401ks are generally offered in either pre or post tax form (contribute to both types if you can). Roth is post tax, meaning all contributions and distributions after 59.5 are tax free. Contributions can be withdrawn dollar for dollar. Most will advise you not to do this. I am not most people. You can beat the market. If the front door was the only way in, that advice would be pretty universal.

With the front door, high income earners can’t contribute at all!

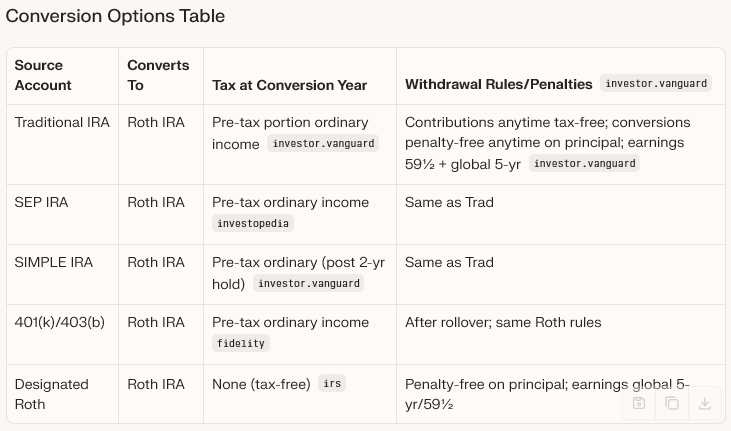

Conversion Funding

The alternate route… limited only by amount of taxes you are willing to incur that year.

Updated: Roll Your 401k, 403b First

If you have a pretax portion of 401k or 403b, you are going to request a rollover to Traditional IRA once your employment status changes with the sponsoring employee. There is another set of strategies here to bring 401k into self managed status, but I won’t go in depth here. Beyond terminations and retirement, there are other employment options that unlock this if it is a fairly highly vested asset from many years of employment. If you don’t plan to leave your current employer but would like to begin self management, contact the plan custodian directly and ask if you can switch to “self directed status” or in-service rollover. Always ask before asking the career altering questions.

Once full time status is changed, the plan sponsor will give you the opportunity to initiate a rollover to traditional ira. Rollover in kind will likely be an option. With this method you won’t have to liquidate your positions on the transaction date. You can specify your existing traditional IRA accounts for rollover in whole or in part. The execution does take longer than a regular brokerage transfer, but I found it to be seamless. From here, you are set up to manage the strategy as follows…

Assets In Kind… The Tax Reduction Jet Fuel

There are many reasons to appreciate lower prices, but this one you may not yet have realized!

If you know what you are doing, volatility can shelter your future tax burden! Of course, that comes with high degree of conviction that the price of the assets you own inevitably must go higher.

What is conversion “in kind”? Simply put, this means the broker will transfer the stocks, bonds, options or possibly even crypto from the pretax basis (TRAD) to the post tax basis (ROTH) assessing the tax on an ordinary income basis on the evening the transfer is initiated (you must initiate in before 3 PM est).

Illustration - The Rick Rule Paladin Scenario

Many of you likely have heard the legendary story of Rick Rule’s 100 bagger trade in $PDN.AX (Paladin) during the last Uranium bull market cycle. Rick is always quick to remind the listener his initial purchase price of $.10 AU dropped below $.01 AU (where he bought more). There part everyone remembers… Rick eventually sold a portion of his holdings for $10 AU, a 100 bagger! There are a few things that were present in Ricks story that need to be present in your scenario to make this work.

Rick had done significant research and had high conviction that the market was mispriced at $.10 and even more-so at $.01. You need to have that conviction level about the asset you intend to convert.

Because you can’t precisely time tops and bottoms you should consider a DCA approach similar to any other trade.

You need to have an idea what you current year tax exposure is. This won’t necessarily be advantageous if you are already in the highest tax bracket for ordinary income. Do the arithmetic!

You need to have a good idea what the stock is actually worth to sell for a significant profit (trade)

You need a long time horizon. This is generally true for IRA investments.

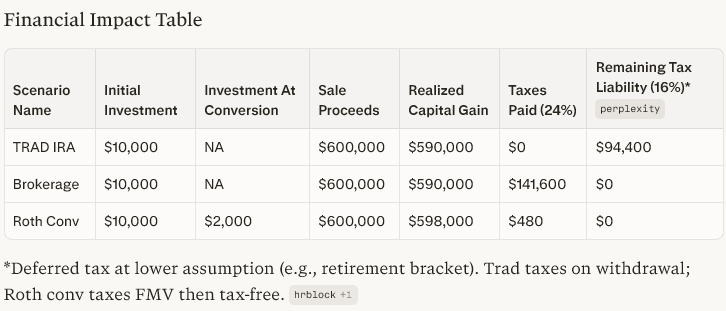

A Scenario Case Study

Suppose you also bought Paladin at $.10 for total investment of $10,000.

The stock proceeded to make its way down and you executed this conversion for average basis of $.02 ($2,000)

You exited the trade near the top for a DCA sale price of $6 per share. ($600,000)

Let’s take a look at the impact on your tax liability via 3 scenarios. You did this solely in a TRAD, solely in a brokerage account and the ROTH conversion path.

Here we have chosen an extreme example to illustrate. While we don’t condone an investment behavior of HOLDing, those who intend to ride volatility for the long run, may have this opportunity in markets in the future (crypto).

How many Bitcoin HODLers will convert and tax shelter their long term, high conviction assets should a dip into the 30s occur. This could actually be the opportunity of a lifetime if the long term bullish thesis occurs. Note: 5GF does not endorsing long term conviction on BTC. DYODD.

What Is Your Plan During A Deep Stage 4 Scenario?

It’s important to set up these account layers in advance of the market moves. Sometimes it can take weeks (see 401k rollovers) to establish the accounts and fund them.

Think About Risk Profile of Pretax IRA

Conventional advisory thinking suggests to protect your Roth from risky assets. You only get 7-8k a year to add to it. If you lose that money, it will be challenging rebuild. This isn’t the case with the conversion scenario. You are dipping the 7-8k annual front door funds.

There is opportunity to speculate in pretax IRAs. If you are wrong and lose money, its pretax money. If you are right and experience a volatile downturn, add it to the ROTH balance, and catch the gains on the way up. To better understand bull and bear market analysis, see my stage analysis market model article:

There are only two kinds of people in the world, those who have held stocks through a bull market into a downturn and people who’ve never owned stock.

If you had done one of these kinds of maneuvers in AMZN 0.00%↑ or PDN 0.00%↑ or countless other survivors of the busts, you would virtually insulate yourself from the enormous capital gain burden. I was you that put the money at risk, did the research, tolerated the downturns. Turn the downturns into additional torque. Prepare to convert!

THERE ARE ALWAYS OPTIONS IN FINANCE, EVEN IN BEAR MARKETS. LEARN TO SPOT THEM!

The information provided is for educational and informational purposes only and should not be construed as investment advice. All investments carry risk, and past performance is not a guarantee of future results.

Roth IRS: https://www.irs.gov/retirement-plans/roth-iras

Trad IRS: https://www.irs.gov/retirement-plans/traditional-iras

Note: Many retires may have a mix of pre and post tax retirement from the Roth 401k and so on. This introduces the “pro-rata” rule: https://www.sdocpa.com/pro-rata-rule/ This rule will lower the tax burden on the scenario you see above. Just know, its not first in last out, or pick and choose to move the post tax items first. Disclaimer: where Pro-rata rule applies; consult tax pro or financial advisor.