ZEBRA Spreads - Tested!

Zero Extrinsic Back Ratio Spreads

Watch the video to fully understand the approach.

Conventional Options illustration of this approach can be found here:

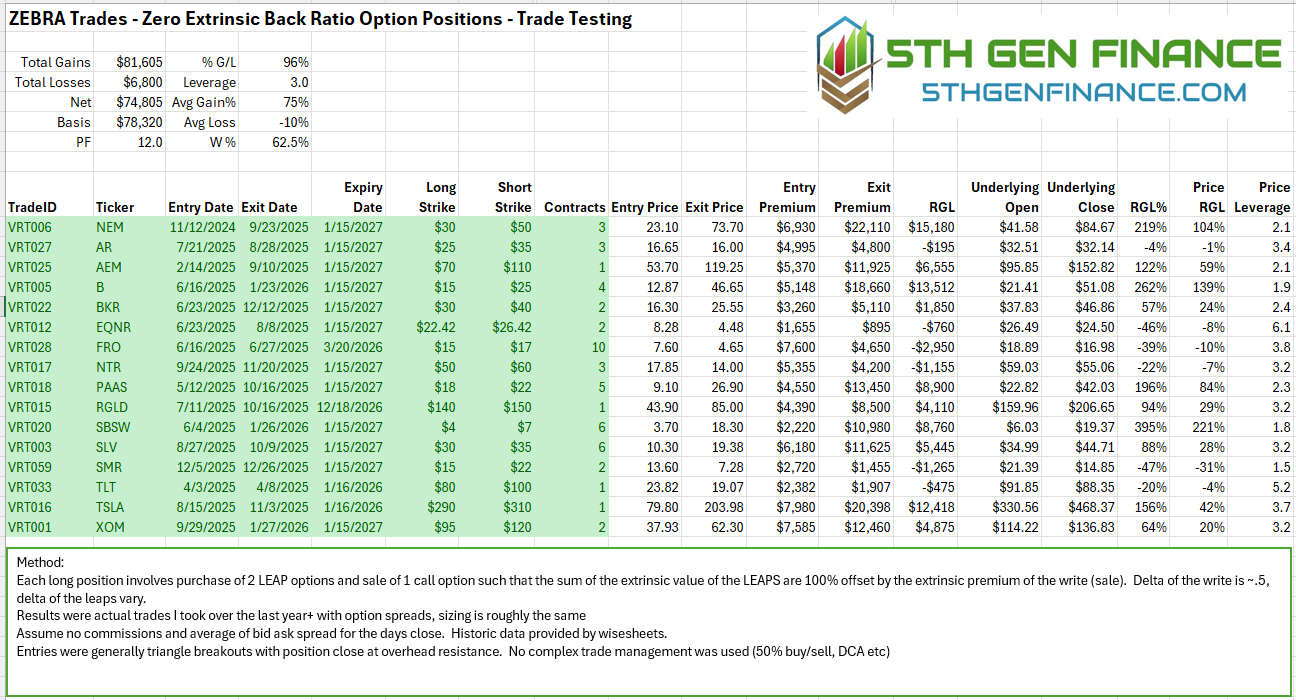

What if we used this method in the commodity accelerator and similar setups? Here are the results:

Benefits:

No need to roll winning trades up when they are in the money. Simpler. No extra commissions.

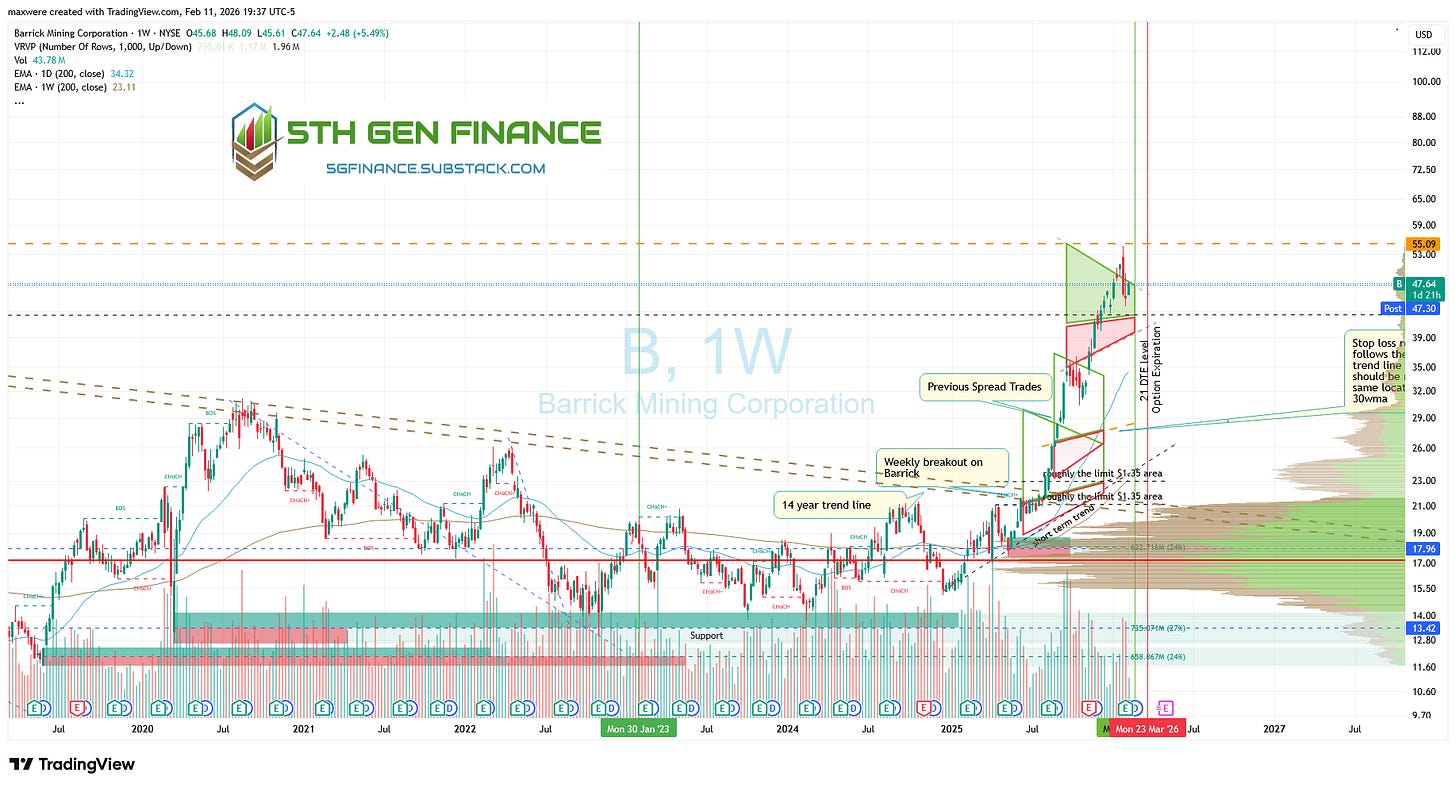

Simple horizontal trade stops and targets work to dictate entries and exits.

Lower downside risk as percent of capital.

Fewer contracts (10-15% as many) mean less bid/ask slippage and loss

Fewer setup steps

Disadvantages:

Less potential profit per $ of premium.

The upward sloping stop on spread can be advantageous and “fit the chart”

Less total VaR. There is always potential for nearly 100% loss in crash scenarios.

Extrinsic ratio calc isn’t straight forward without a spreadsheet calculator tool. Can be tricking to find the right match of contracts

Less liquid in deep in the money options. Can be harder to find setups.

The information provided is for educational and informational purposes only and should not be construed as investment advice. All investments carry risk, and past performance is not a guarantee of future results. Trading options involves a high degree of risk and is not suitable for all investors.