Bulletin: Initiating CA trade plan setup (FREE)

$RIO is back-testing its breakout from 3 weeks ago. Adding positions today.

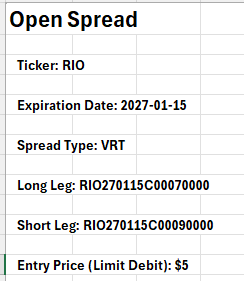

UPDATE: filled at $5 debit.

What to like

On Thesis Trade - with the bullish setups in emerging markets, iron ore and copper, 2026 is looking bright for RIO 0.00%↑ .

Long Duration, Low Stress - this trade is built to not need a roll. It’s tax advantaged for brokerage accounts due to extended expiration. It can withstand some of the volatility overflow of other falling sectors that seem imminent. Don’t worry about near term volatility.

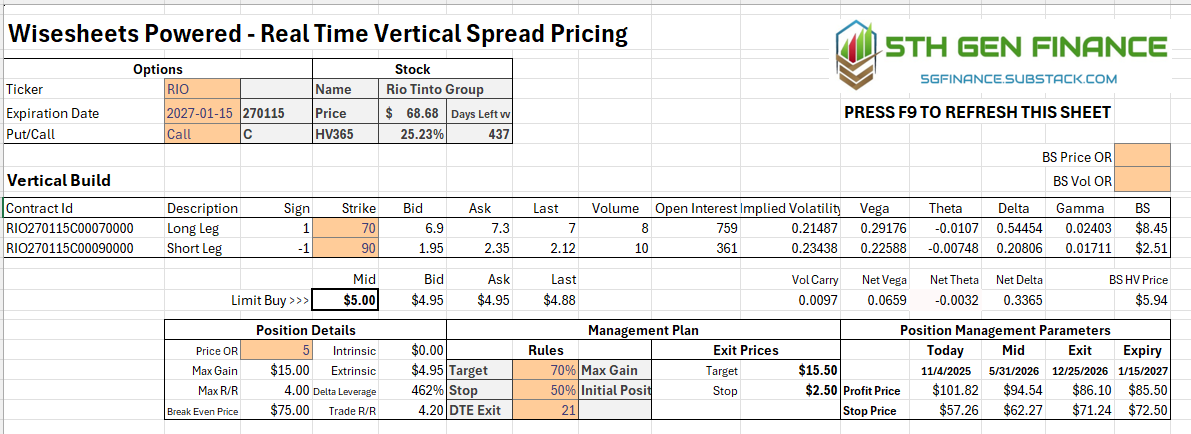

400% Risk Reward - as always steep symmetry in our favor.

What is not favorable

Lack of liquidity - in the option market on RIO 0.00%↑. Use limit orders only and be patient for a fill.

Trade Plan Visualized

Quantitative Metrics

At nearly 20% discount to black-scholes the price more than offsets low liquidity. This spread is essentially time premium neutral at the moment.

What is the CA trade plan?

If you are new, be sure and check out the trade plan and backtest results. This includes how to enter, exit and our proprietary stop/target method you see drawn on the chart above.

The information provided is for educational and informational purposes only and should not be construed as investment advice. All investments carry risk, and past performance is not a guarantee of future results. Trading options involves a high degree of risk and is not suitable for all investors.