Sorry Gold & Silver Bugs, The Easy Money Has Been Made

Gold is hard money after all... its hard money the rest of the way up.

Wherever it ends up, the price of gold and silver after this bull market is likely to linger in the 3500-6000/50-100 area or even 4000-4500/65-75 for a long time. (assuming gold doesn’t get re-instated as global reserve asset) Why? Because (particularly in the case of silver) there is enough in ground to be produced at a cost of 40-50. That leaves room for the requisite incentive margins for production and sustaining capital.

What does this mean?

It means the rest of this bull journey is… speculative… arithmetically speaking. No more, “buy silver for $25 and wait for markets to realize they might want some to keep making stuff”. That was the easy money. Be prepared to trim the highs and nibble on the lows. If the last two weeks are any indication, its a lot more work… and a lot more risk.

Where is the lower emotional capital investment now?

If you missed it earlier this week coal is on the list:

The short answer… cheap (clean) energy. That’s nuclear, that’s especially natural gas. Consider $BTC , MSTR 0.00%↑ , silver, gold, PGMs over the last week. Volatility is 6-8X. Now look at XOM 0.00%↑ , CVX 0.00%↑ , XLE 0.00%↑ , DVN 0.00%↑ … apparently missed the systemic failure memo!

Charts that have tremendous potential for “easy money”…

Oil and Gas

$BIR.TX

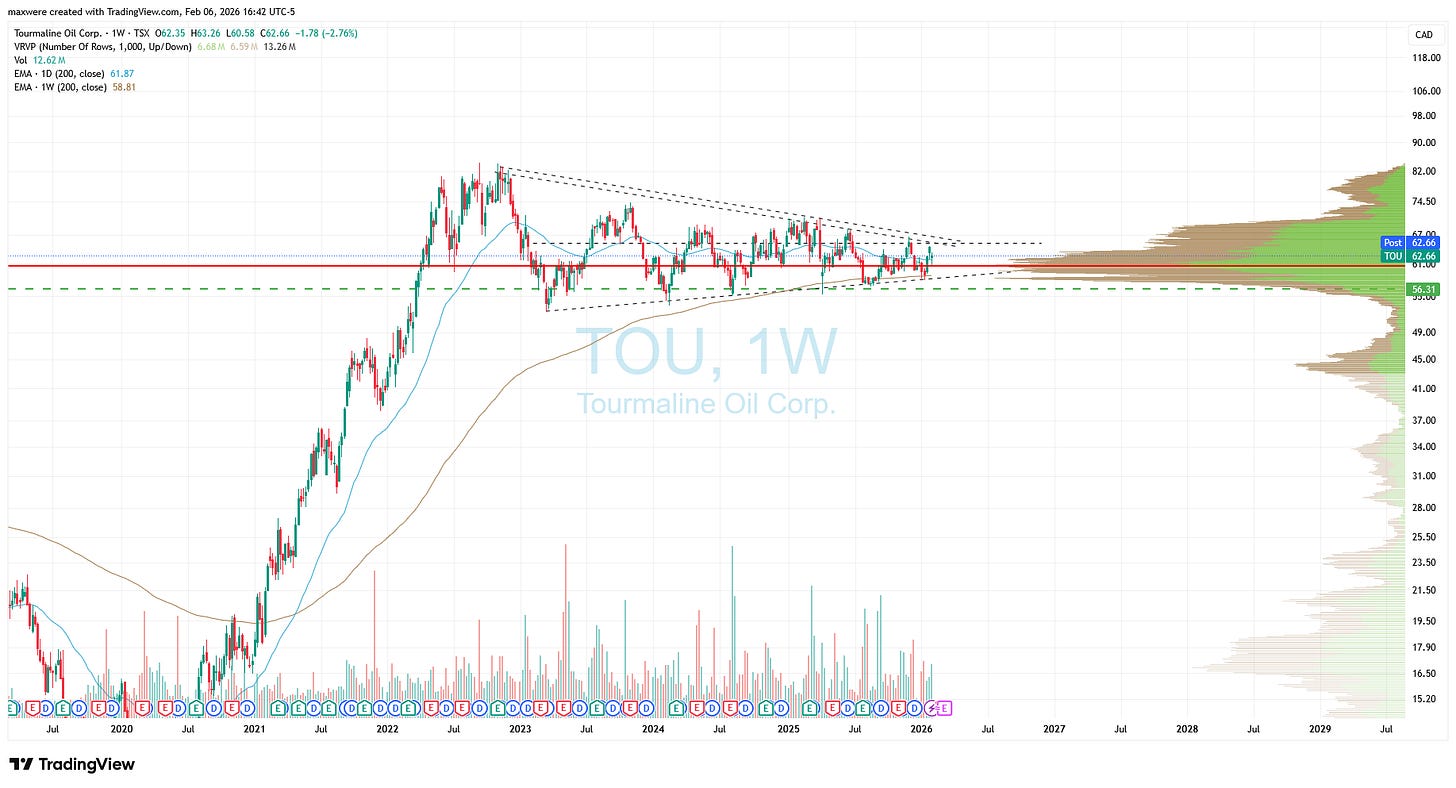

$TOU.TX

AR 0.00%↑ - On stuff

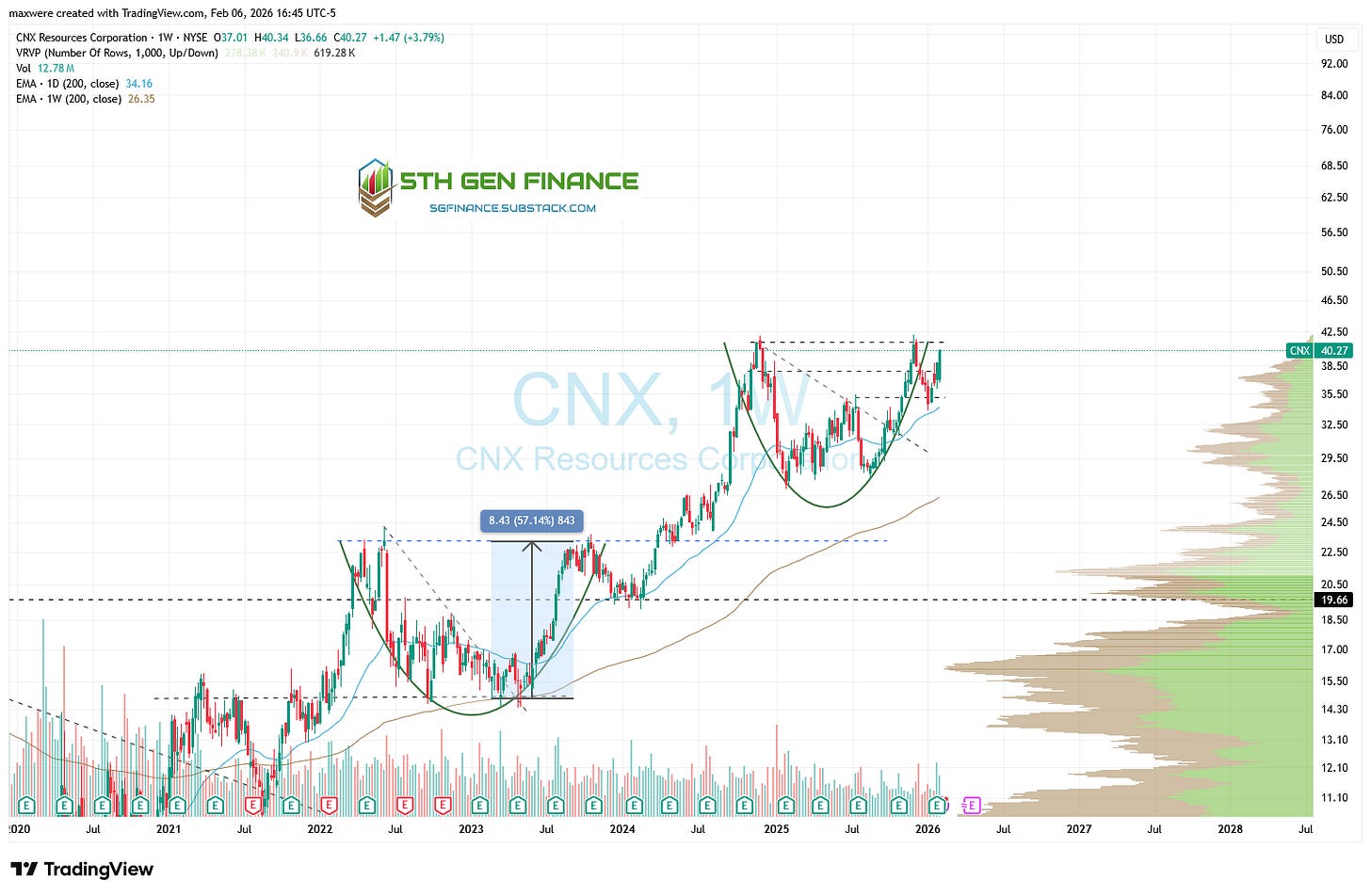

CNX 0.00%↑ - Cup and Handle #2

$ARX.TX - Roughest chart of the bunch but today’s 10% drop brought them into about an 8 multiple. Not accounting for much higher pricing.

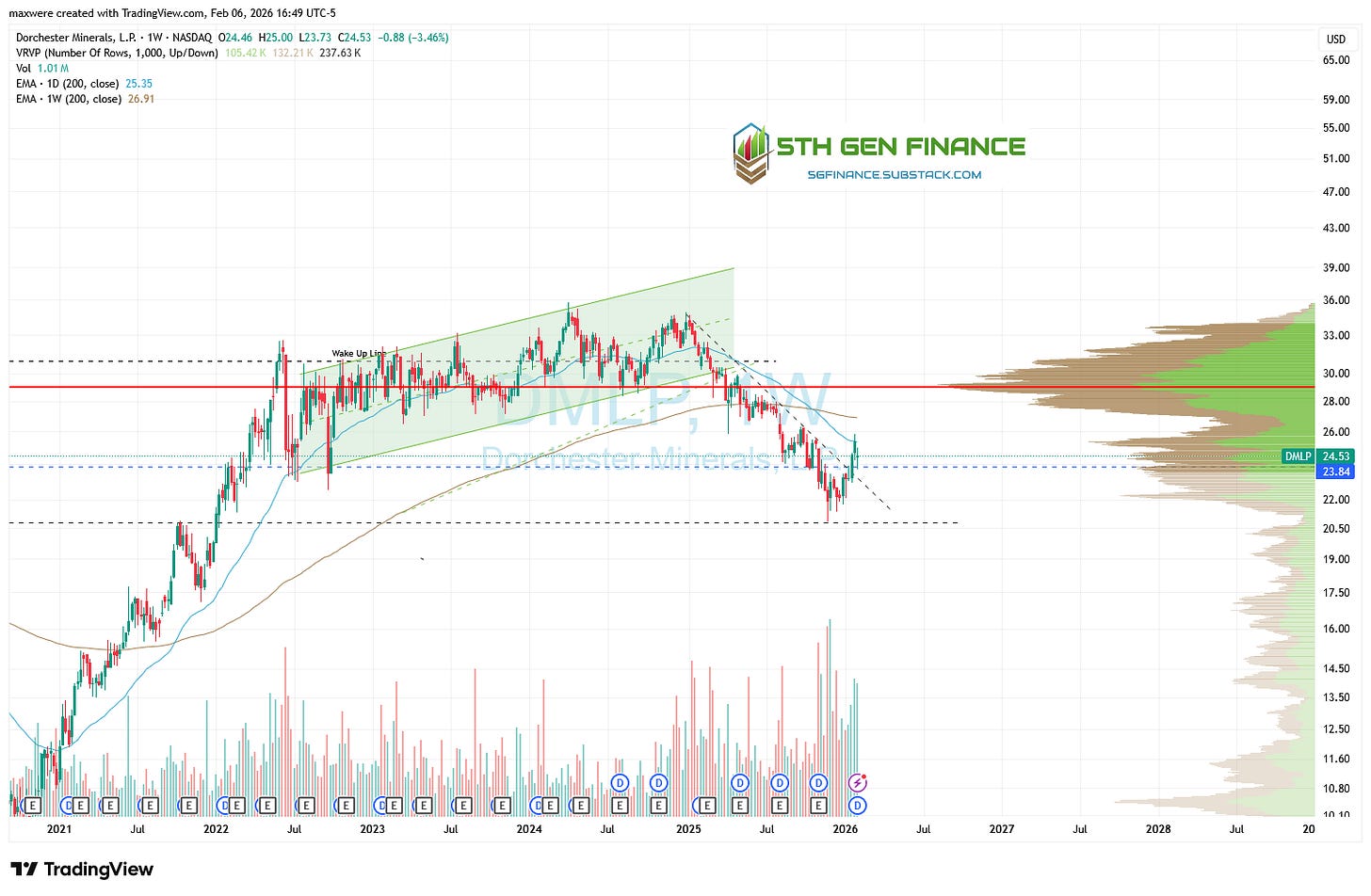

DMLP 0.00%↑ - royalties, beaten up

BSM 0.00%↑ - IH&S situation.

Uranium

$SRUUF Textbook IH&S entry.

URNM 0.00%↑ - Backtest of its trend line.

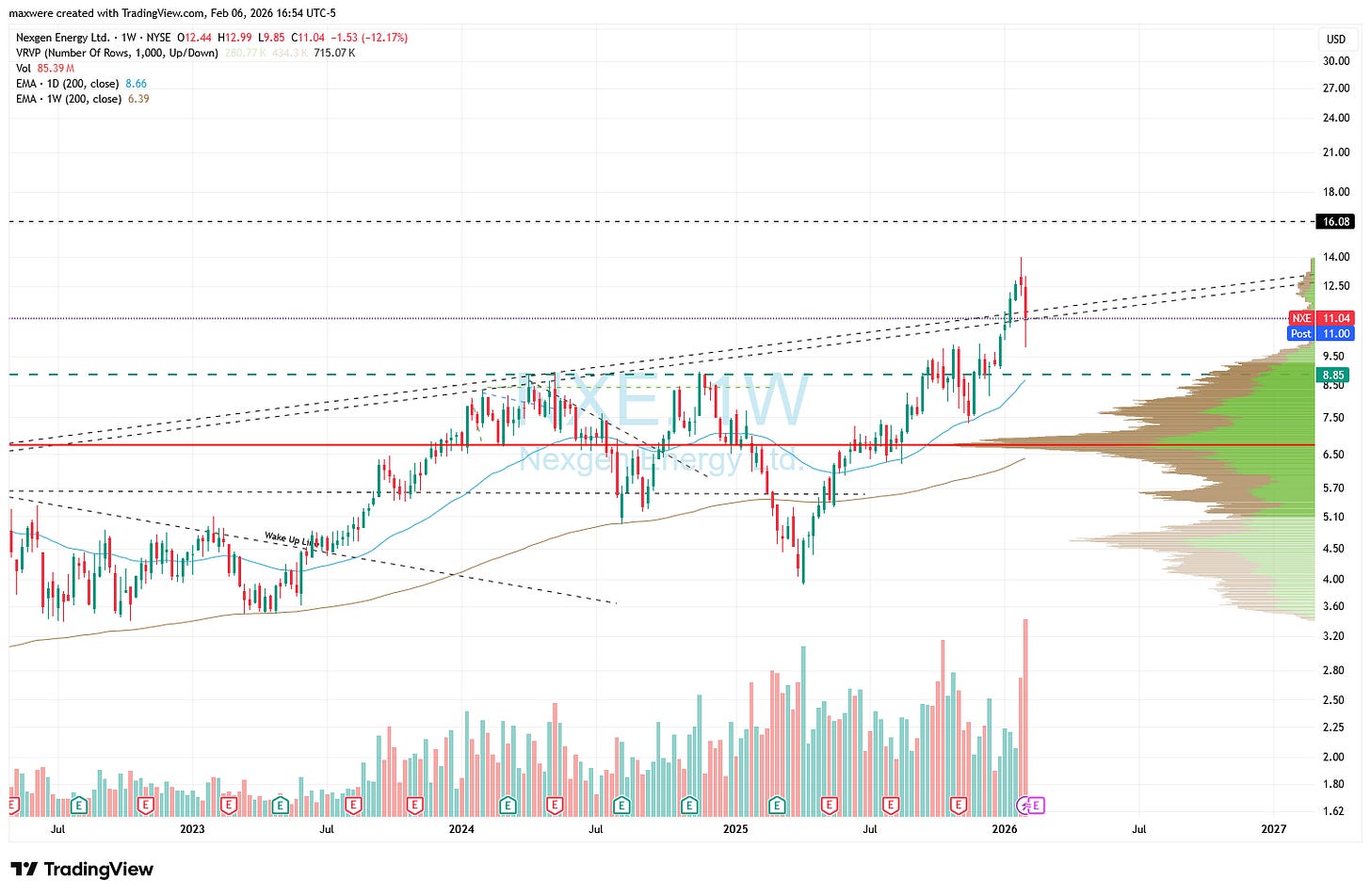

NXE 0.00%↑ short report rejected off the long term trend support.

$AEU.AX - Atomic Eagle (formerly Goviex)

Base Metals

COAL 0.00%↑ - Range Global

NIKL 0.00%↑ - hoping for a retest to the neckline. Am I too greedy?

The information provided is for educational and informational purposes only and should not be construed as investment advice. All investments carry risk, and past performance is not a guarantee of future results. Trading options involves a high degree of risk and is not suitable for all investors.